Indian Rupee Climbs To 2-day High Versus U.S. Dollar After RBI Decision

December 03 2020 - 8:13PM

RTTF2

The Indian rupee appreciated against the U.S. dollar in the

morning session on Friday, as India's central bank left its key

interest rates unchanged as widely expected due to higher

inflation.

The Monetary Policy Committee, led by Governor Shaktikanta Das,

voted unanimously to hold the policy repo rate at 4.00 percent. The

reverse repo rate was retained at 3.35 percent.

The Marginal Standing Facility or MSF rate, and the Bank rate

remained unchanged at 4.25 percent.

Das said the bank will continue with accommodative policy stance

as long as necessary, at least for the current financial year and

into the next year.

The bank projected real GDP to fall 7.5 percent in the financial

year 2021-21. Das said inflation is likely to remain elevated. This

constrains monetary policy at the current juncture.

The rupee firmed to a 2-day high of 73.62 against the greenback

from yesterday's closing value of 73.84. Next key resistance for

the rupee is seen around the 72.00 region.

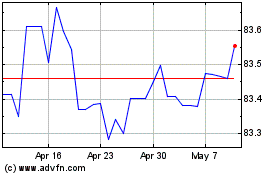

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

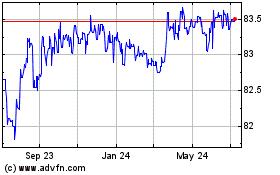

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024