Dollar Advances On Rising U.S.-China Tensions

June 04 2020 - 12:50AM

RTTF2

The U.S. dollar strengthened against its major rivals in the

early European session on Thursday, as heightened tensions between

the U.S. and China dampened risk sentiment.

Tensions flared up after the Trump administration barred Chinese

airlines from flying into the U.S. from June 16 in retaliation

against Beijing's restrictions on American and foreign

carriers.

Shortly after the announcement, the Civil Aviation

Administration of China (CAAC) said it would allow once-per-week

flights into a city of their choosing starting on June 8.

All airlines will be allowed to increase the number of

international flights involving China to two per week if no

incoming passengers on their flights test positive for Covid-19 for

3 consecutive weeks.

Investors await weekly jobless claims and the U.S. trade data

due later in the day, as well as the Labor Department's monthly

jobs report on Friday for more direction.

The greenback approached 109.15 versus the yen, its highest

level since April 7. The greenback is seen finding resistance

around the 112.00 level.

The greenback rose to 1.3530 against the loonie, 0.6882 against

the aussie and 0.6404 against the kiwi, from its early lows of

1.3489, 0.6933 and 0.6433, respectively. The next possible

resistance for the greenback is seen around 1.37 against the

loonie, 0.66 against the aussie and 0.62 against the kiwi.

The greenback advanced to a 2-day high of 1.2501 versus the

pound, from a low of 1.2581 hit at 7:30 pm ET. If the greenback

extends rise, 1.22 is possibly seen as its next resistance

level.

The greenback edged higher to 1.1197 versus the euro, after

falling to 1.1238 at 5:45 pm ET. On the upside, 1.10 is possibly

seen as the next resistance for the greenback.

In contrast, the greenback dropped to 0.9605 against the franc,

setting a 2-day low. The greenback is poised to target support

around the 0.94 level.

Looking ahead, Eurozone retail sales for April are due out in

the European session.

The European Central Bank will announce interest rate decision

at 7:45 am ET. The ECB is expected to hold its main refi rate at a

record low zero percent and the deposit rate at -0.50 percent.

In the New York session, U.S. and Canadian trade data for April

as well as weekly jobless claims for the week ended May 30 are

scheduled for release.

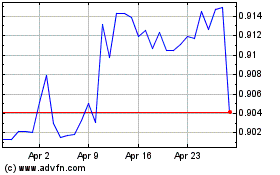

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024