Philippine CB Cuts Rate For Second Time In A Row

September 26 2019 - 4:19AM

RTTF2

The Philippine central bank slashed its key interest rate by a

quarter-point for a second consecutive session, and a third time

thus far this year, as inflation slowed to its weakest level in

nearly three years amid weak economic growth.

The Monetary Board of the Bangko Sentral ng Pilippinas, or BSP,

on Thursday decided to lower the overnight reverse repurchase

facility rate by 25 basis points to 4.00 percent. The move was in

line with economists' expectations.

The previous change in the rate was a quarter-point reduction in

August, after a surprise similar size cut in May, which was the

first since 2016.

Late August, BSP Governor Benjamin Diokno had signaled that the

rate will be cut by another quarter-point before the end of this

year.

However, Alex Holmes, an economist at Capital Economics, expects

more cuts in coming quarters with growth likely to disappoint and

subdued price pressures. The economist forecast two rate cuts, that

will take the policy rate to 3.50 percent.

The central bank expects inflation to settle within the lower

half of the target range of 2-4 percent until 2021. The balance of

risks to the inflation outlook shifted toward the upside for 2020

and tilted to the downside for 2021.

The bank had earlier lowered its inflation forecast for 2019 to

2.5 percent from 2.6 percent.

The board viewed that prospects for global economic growth are

likely to remain weak owing mainly to uncertainty over trade

policies. Nonetheless, firm domestic spending and progress on

policy reforms will serve as a buffer against global headwinds.

The economy had expanded 5.5 percent in the second quarter,

which was the weakest growth in four years. The government targets

6-7 percent growth for this year.

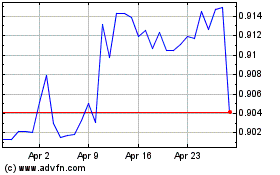

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024