Canadian Dollar Falls On Disappointing GDP Data

March 01 2019 - 4:45AM

RTTF2

The Canadian dollar dropped against its major counterparts in

the European session on Friday, as the Canadian economy grew at a

much slower pace than forecast in the fourth quarter of 2018.

Data from Statistics Canada showed that the economy grew at an

annualised pace of 0.4 percent in the fourth quarter, after rising

2.0 percent in the previous quarter. Economists had forecast a 1.2

percent growth.

On a month-on-month basis, the GDP dropped 0.1 percent, the same

rate as in November. Economists had expected the growth to be

stagnant.

The currency was further weighed by falling oil prices, led by

surging U.S. supply and worries over a global economic

slowdown.

Crude for April delivery fell $0.15 to $57.07 per barrel.

China manufacturing sector contracted for the third straight

month in February, survey data from IHS Markit showed.

The Caixin China Manufacturing Purchasing Managers' Index came

in at 49.9 in February versus 48.3 in January.

The loonie has been trading higher against its major

counterparts in the Asian session.

The loonie fell to a weekly low of 1.3241 against the greenback

and a 3-week low of 1.5069 against the euro, from its early 2-day

high of 1.3130 and a 4-day high of 1.4920, respectively. The next

possible support for the loonie is seen around 1.35 against the

greenback and 1.50 against the euro.

The loonie dropped to 0.9405 against the aussie and 84.47

against the yen, off its early high of 0.9316 and near a 3-month

high of 85.24, respectively. If the loonie falls further, 0.95 and

82.5 are likely seen as its next support levels against the aussie

and the yen, respectively.

Looking ahead, U.S. ISM manufacturing index for February and

University of Michigan's final consumer sentiment index for

February are due shortly.

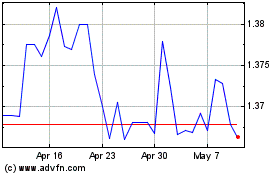

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024