Japanese Yen Falls On Oil Rally

April 05 2022 - 4:09AM

RTTF2

The Japanese yen slipped against its major counterparts in the

European session on Tuesday amid safe-haven status, as a rally in

oil prices on the prospect of more sanctions against Russia lifted

risk sentiment.

The United States and Europe signaled more sanctions on Russia

for committing "war crimes" in Ukraine.

The European Union will probably adopt a new round of sanctions

against Russia on Wednesday, France's European Affairs Minister

Clement Beaune said.

President Volodymyr Zelensky will speak at a meeting of United

Nations Security Council, which is expected to be dominated by

civilian atrocities in Ukraine.

Earlier in the day, Bank of Japan Governor Haruhiko Kuroda

cautioned against the recent depreciation of the yen against the

U.S. dollar, saying that currency movements are "somewhat rapid"

and should be stable.

The latest survey from Jibun Bank showed that Japan services

sector continued to contract in March, albeit at a slower rate,

with a services PMI score of 49.4.

That's up from 44.2 in February, although it remains beneath the

boom-or-bust line of 50 that separates expansion from

contraction.

The yen dropped to 8-day lows of 93.90 against the aussie and

86.09 against the kiwi, off its prior highs of 92.26 and 85.02,

respectively. The yen is poised to challenge support around 96.00

against the aussie and 89.00 against the kiwi.

The yen weakened to a 1-week low of 98.74 against the loonie and

a 4-day low of 123.00 against the greenback, pulling back from its

previous highs of 97.99 and 122.37, respectively. The next possible

support for the yen is seen around 100.00 against the loonie and

124.00 against the greenback.

Reversing from its early highs of 160.50 against the pound and

132.18 against the franc, the yen depreciated to a 1-week low of

161.50 and a 4-day low of 132.85, respectively. The yen is seen

finding support around 164.00 against the pound and 134.00 against

the franc.

The yen edged down to 135.12 against the euro, after climbing to

an 8-day high of 134.29 in previous deals. On the downside, 137.00

is possibly seen as the next support level for the currency.

Looking ahead, U.S. and Canadian trade data for February and ISM

non-manufacturing PMI for March will be released in the New York

session.

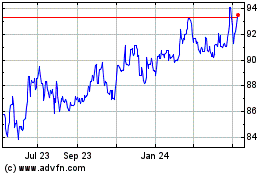

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Mar 2024 to Apr 2024

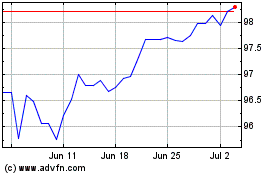

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Apr 2023 to Apr 2024