Japanese Yen Declines As Asian Stocks Advance Amid Russia-Ukraine Talks

March 09 2022 - 9:50PM

RTTF2

The Japanese yen dropped against its major opponents in the

Asian session on Thursday, as Asian stocks followed Wall Street

higher, with investors focused on talks between Russia and Ukraine

to reach a ceasefire agreement.

Russian foreign minister Sergei Lavrov and his Ukrainian

counterpart Dmytro Kuleba are holding talks in Turkey to resolve

the conflict in a diplomatic manner.

Ukraine said that it is ready for discussions on neutrality

demand, but security guarantees from Russia would not be

sufficient.

Ukrainian President Zelensky stated that he is prepared to

compromise on the status of the two breakaway pro-Russian

territories and dropped the push to join the NATO alliance.

A rally in commodity prices has paused, though oil regained some

ground following comments from the United Arab Emirates energy

minister that the OPEC is committed to the existing deal to boost

oil production by 400,000 barrels per day.

Data from the Bank of Japan showed that Japan producer prices

accelerated 9.3 percent on year in February.

That exceeded expectations for an increase of 8.7 percent and

was up from the upwardly revised 8.9 percent in January (originally

8.6 percent).

The yen dropped to a 3-day low of 125.23 against the franc and a

1-week low of 128.49 against the euro, off its early highs of

124.89 and 128.11, respectively. The yen is poised to face support

around 129.00 against the franc and 130.00 against the euro.

Recovering from its early highs of 152.53 against the pound and

115.81 against the greenback, the yen fell to a 6-day low of 152.99

and near a 4-week low of 116.20, respectively. The currency is

likely to face support around 156.00 against the pound and 118.00

against the greenback.

The yen pulled back from its prior highs of 84.57 against the

aussie, 79.04 against the kiwi and 90.37 against the loonie,

sliding to 3-day lows of 85.13, 79.42 and 90.68, respectively. The

yen is seen facing support around 88.00 against the aussie, 82.00

against the kiwi and 92.00 against the loonie.

Looking ahead, the European Central Bank will announce interest

rate decision at 7:45 am ET. The ECB is expected to hold its main

refi rate at a record low zero percent and the deposit rate at

-0.50 percent.

U.S. weekly jobless claims for the week ended March 5, consumer

inflation data and monthly budget statement for February will be

featured in the New York session.

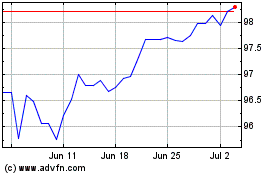

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Mar 2024 to Apr 2024

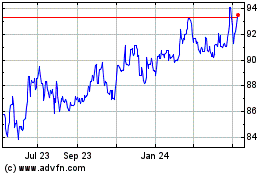

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Apr 2023 to Apr 2024