Australian, NZ Dollars Advance On PBoC Easing Hopes, Receding Russia-Ukraine Tensions

February 15 2022 - 9:29PM

RTTF2

The Australian and NZ dollars climbed against their major

opponents in the Asian session on Wednesday, as risk sentiment

improved amid easing fears of an imminent attack by Russia on

Ukraine and on expectations for more policy easing from the

People's Bank of China following soft inflation data.

Russia said on Tuesday that some of its troops from the borders

of Ukraine were returning to deployment bases after after

completing the exercises.

Official data showed that China's consumer and producer

inflation rose less than expected in January.

Consumer prices climbed 0.9 percent on year in January, missing

expectations for an increase of 1.0 percent and down sharply from

1.5 percent in December.

Investors focus on the minutes from the Federal Reserve's

January policy meeting due later today for more clarity on the pace

of monetary tightening and the possibility of a 50 basis point move

next month.

The aussie advanced to 5-day highs of 82.86 against the yen and

0.7162 against the greenback, after dropping to 82.61 and 0.7143,

respectively in early deals. The aussie is seen finding resistance

around 84.00 against the yen and 0.74 against the greenback.

Reversing from its early lows of 1.5888 against the euro and

1.0762 against the kiwi, the aussie edged higher to 1.5851 and

1.0781, respectively. Next key resistance for the aussie is

possibly seen around 1.54 against the euro and 1.09 against the

kiwi.

The aussie touched 0.9116 against the loonie, hitting a 5-day

high. The currency is likely to challenge resistance around the

0.94 level.

The kiwi moved up to a 5-day high of 76.91 against the yen and a

2-day high of 0.6649 against the greenback, off its early lows of

76.70 and 0.6633, respectively. The kiwi is poised to find

resistance around 78.00 against the yen and 0.68 against the

greenback.

The kiwi recovered from an early low of 1.7110 against the euro,

climbing to 1.7073. If the kiwi rises further, 1.66 is likely seen

as its next resistance level.

Looking ahead, Eurozone industrial production for December is

due in the European session.

Canada CPI for January and wholesale sales for December, as well

as U.S. retail sales, industrial production and export and import

prices, all for for January, business inventories data for December

and NAHB housing market index for February will be released in the

New York session.

The Fed minutes from the January 25-26 meeting are set for

release at 2:00 pm ET.

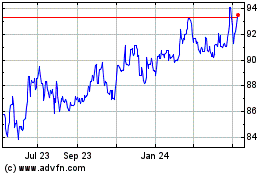

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Mar 2024 to Apr 2024

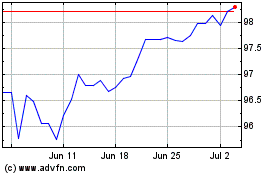

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Apr 2023 to Apr 2024