Japanese Yen Drops As Fed Comments Soothe Aggressive Tightening Concerns

February 01 2022 - 10:22PM

RTTF2

The Japanese yen fell against its most major counterparts in the

Asian session on Wednesday, as Asian shares are mostly higher,

tracking gains on Wall Street overnight, following comments from

several Federal Reserve officials playing down the possibility of

aggressive rate hikes this year.

Philadelphia Fed President Patrick Harker said that he supported

four 25 basis point rate hikes for this year, but a 50 basis point

move is not preferred.

Atlanta Fed President Raphael Bostic said on Tuesday that there

is a real risk of inflation expectations drifting higher and thus

an action to reduce accommodation is required soon.

St. Louis Federal Reserve President James Bullard advocated

lifting rates at the meetings in March and May, but opposed the

idea of a half-percentage point move next month.

Investors cheered the positive earnings news and the latest data

on U.S. manufacturing and job openings showing a resilient economy.

Google parent Alphabet reported better-than-expected fourth-quarter

earnings and revenue in after-hours trading.

The yen depreciated to an 8-day low of 124.60 against the franc

and a 2-day low of 155.22 against the pound, after rising to 124.29

and 154.93, respectively in early trades. The next likely support

for the yen is seen around 126.00 against the franc and 157.00

against the pound.

The yen touched a 1-week low of 81.99 against the aussie, down

from a high of 81.66 seen at 5:00 pm ET. If the yen continues its

fall, 83.00 is possibly seen as its next support level.

The yen edged down to 129.40 against the euro and 90.51 against

the loonie, off its early highs of 129.19 and 90.34, respectively.

Next key support for the yen is likely seen around 132.00 against

the euro and 92.00 against the loonie.

In contrast, the yen advanced to 114.58 against the greenback

and 76.01 against the kiwi, following its prior low of 114.80 and a

6-day low of 76.28, respectively. The yen is seen finding

resistance around 112.5 against the greenback and 75.00 against the

kiwi.

Looking ahead, Eurozone CPI for January is due in the European

session.

U.S. ADP private payrolls data for January is scheduled for

release at 8:15 am ET.

Canada building permits for December will be featured in the New

York session.

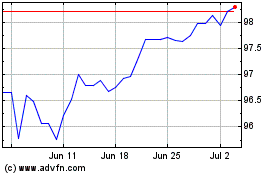

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Mar 2024 to Apr 2024

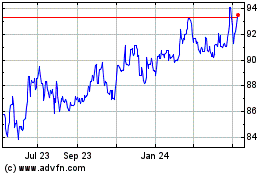

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Apr 2023 to Apr 2024