Australian, NZ Dollars Higher At Start Of Week

January 30 2022 - 10:14PM

RTTF2

The Australian and NZ dollars advanced against their major

counterparts in the Asian session on Monday, as Asian shares are

mostly higher following the broadly positive cues from Wall Street

on Friday, ahead of key events including rate decisions from major

central banks due throughout this week.

The Reserve Bank of Australia will hold its first meeting of the

year on Tuesday. The central bank is expected to end its bond

buying program amid high inflation.

The Bank of England and the European Central Bank will deliver

their policy announcements on Thursday. While the BoE is widely

expected to deliver another increase in the key interest rate, the

ECB is seen maintaining its monetary policy and is unlikely to give

any signals on possible rate hikes.

Earnings reports from Alphabet, Amazon and Meta Platforms are

also in focus.

Inflation fears eased following last week's U.S. core personal

consumption expenditure price index data that came in broadly in

line with expectations.

The aussie advanced to 0.7030 against the greenback and 1.5867

against the euro, off its early lows of 0.6987 and 1.5953,

respectively. The next possible resistance for the aussie is seen

around 0.72 against the greenback and 1.54 against the euro.

The aussie climbed to 81.21 against the yen and 0.8949 against

the loonie, after falling to 80.55 and 0.8920, respectively in

prior deals. The aussie is poised to face resistance around 83.00

against the yen and 0.93 against the loonie.

The aussie edged higher to 1.0699 against the kiwi, from a low

of 1.0667 seen at 5:15 pm ET. On the upside, 1.09 is likely seen as

its next resistance level.

The kiwi reversed from its prior lows of 0.6538 against the

greenback and 1.7035 against the euro, rising to 0.6575 and 1.6979,

respectively. The currency may possibly challenge resistance around

0.68 against the greenback and 1.66 against the euro.

Recovering from its previous low of 75.38 against the yen, the

kwi gained to 75.92. If the kiwi rises further, 78.00 is likely

seen as its next resistance level.

Looking ahead, Eurozone flash GDP data for the fourth quarter is

due in the European session.

At 8:00 am ET, German preliminary CPI for January is scheduled

for release.

Canada industrial product price index for December will be

released in the New York session.

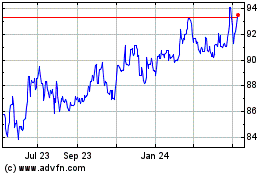

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Mar 2024 to Apr 2024

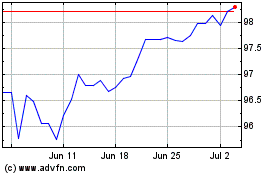

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Apr 2023 to Apr 2024