U.S. Dollar Rises On Growth, Inflation Worries

September 13 2021 - 12:31AM

RTTF2

The U.S. dollar climbed against its major counterparts in the

Asian session on Monday amid safe haven status, as risk sentiment

dampened on concerns over a slowdown in global economic growth and

indications of higher inflation.

Comments from several Fed officials supporting a reduction in

stimulus measures this year clouded outlook.

Federal Reserve Bank of Philadelphia President Patrick Harker

said that he supports moving toward a tapering process sooner

rather than later.

U.S. producer prices rose at the fastest pace in over a decade,

renewing concerns over the risk of higher inflation.

Further undermining risk sentiment was the Financial Times

report that Beijing is planning to split Ant Group's Alipay and

create a separate app for the company's loans business.

As per the report, Ant will turn over user data for lending

decisions to create a separate joint venture.

The greenback climbed to 4-day highs of 110.16 against the yen,

0.9216 against the franc and 1.3797 versus the pound, up from its

previous lows of 109.79, 0.9171 and 1.3846, respectively. The

greenback is poised to target resistance around 112.00 against the

yen, 0.95 against the franc and 1.36 versus the pound.

The greenback appreciated to more than a 2-week high of 1.1775

against the euro and near a 2-week high of 0.7336 against the

aussie, off its early lows of 1.1815 and 0.7368, respectively. On

the upside, 1.15 and 0.70 are possibly seen as the next resistance

levels for the greenback against the euro and the aussie,

respectively.

The greenback rebounded from its early lows of 0.7121 against

the kiwi and 1.2661 against the loonie, reaching 0.7098 and a

session's high of 1.2695, respectively. Immediate resistance is

seen near 0.68 against the kiwi and 1.28 against the loonie.

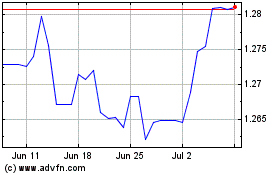

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024