Canadian Dollar Firms On Higher Oil Prices

April 12 2019 - 4:22AM

RTTF2

The Canadian dollar strengthened against its most major

counterparts in the European session on Friday, as oil prices were

buoyed by OPEC-led supply cuts, escalating fighting in Libya and

U.S. sanctions on petroleum exporters Iran and Venezuela.

Crude for May delivery rose $0.88 to $64.45 per barrel.

Venezuela's average daily production rate fell to 870,000 bpd

last month, while OPEC-wide production fell by 550,000 bpd in

March, the International Energy Agency said in its oil market

report.

Saudi Arabia's crude oil production slumped to the lowest in two

years as the Kingdom slashed its production by more than promised

to boost prices.

The oil cartel and its allies will meet in June to decide

whether to continue withholding supply.

OPEC is expected to consider raising oil output from July if

disruptions continue and prices keep rallying.

The currency traded mixed against its major counterparts in the

Asian session. While it rose against the aussie and the yen, it

held steady against the greenback. Against the euro, it

dropped.

The loonie climbed to 84.04 against the yen, its strongest since

March 19, and marked a 0.8 percent drop from a low of 83.38 seen at

5:00 pm ET. The loonie is poised to find resistance around the

86.00 level.

The loonie appreciated to 1.3324 against the greenback,

following a low of 1.3386 touched at 5:00 pm ET. The next possible

resistance for the loonie is seen around the 1.31 level.

The loonie bounced off to 1.5069 against the euro, from more

than a 2-week low of 1.5100 hit at 8:45 pm ET. If the loonie rises

further, 1.48 is possibly seen as its next resistance level.

Data from Destatis showed that Germany's wholesale price

inflation rose further in March.

The wholesale price index rose 1.8 percent year-on-year in

March, following a 1.6 percent rise in February.

On the flip side, the loonie weakened to 0.9564 against the

aussie, reversing from a 2-day high of 0.9519 set at 4:00 am ET.

The loonie is seen finding support around the 0.965 level.

Looking ahead, U.S. export and import prices for March and

University of Michigan's preliminary consumer sentiment index for

April will be released in the New York session.

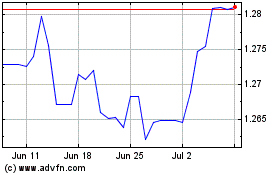

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Apr 2023 to Apr 2024