Pound Higher As U.K. Inflation Accelerates To 10-year High

December 14 2021 - 11:42PM

RTTF2

The pound gained ground against its major counterparts in the

European session on Wednesday, as the nation's consumer inflation

surged in November to the highest level since September of

2011.

Data from the Office for National Statistics showed that

consumer price inflation rose to 5.1 percent in November from 4.2

percent in October. This was the biggest rate since September 2011,

when inflation stood at 5.2 percent.

The rate was forecast to rise to 4.7 percent. The inflation rate

stands well above the central bank's target of 2 percent.

On a monthly basis, consumer prices grew 0.7 percent, following

October's 1.1 percent increase. Prices were forecast to climb 0.8

percent.

Core inflation that excludes energy, food, alcoholic beverages

and tobacco, advanced to 4 percent from 3.4 percent in October.

Another report from the ONS showed that factory gate inflation

increased at the fastest pace since September 2008. Output price

inflation climbed to 9.1 percent in November from 8.6 percent in

the previous month.

On the month, the rate of output inflation was 0.9 percent, but

down from 1.5 percent in October.

Further, data showed that input price inflation hit its highest

rate since August 2008. Input price inflation rose to 14.3 percent

from 13.7 percent in October.

Month-on-month, input prices gained 1 percent versus 1.6 percent

a month ago.

The Bank of England will deliver its rate decision on Thursday.

Market participants widely expect it to hold off on raising rates

due to the economic threats from the spread of Omicron coronavirus

variant.

The pound firmed to an 8-day high of 1.3282 against the dollar

from yesterday's close of 1.3225. The currency may possibly

challenge resistance around the 1.34 level.

The pound reached as high as 1.2278 against the franc, setting

an 8-day high. The pair had closed Tuesday's deals at 1.2207. The

pound is seen finding resistance around the 1.24 level.

The pound jumped to an 8-day high of 151.01 against the yen, up

from Tuesday's close of 150.41. The pound may test resistance

around the 153.00 region, should it rallies again.

The pound climbed to 0.8486 against the euro for the first time

since November 30. At Tuesday's close, the pair was valued at

0.8509. On the upside, 0.82 is possibly seen as its next resistance

level.

Looking ahead, U.S. retail sales and export and import prices

for November, as well as business inventories data for October, New

York Fed's empire manufacturing index and NAHB housing market index

for December will be released in the New York session.

At 2:00 pm ET, the Fed announces its decision on interest rate.

Economists widely expect the federal funds rate to be kept at

0-0.25 percent.

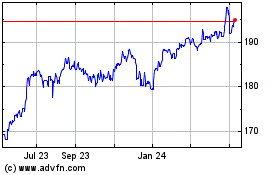

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024