U.S. Dollar Lower On President Trump Impeachment

December 18 2019 - 8:55PM

RTTF2

The U.S. dollar depreciated against its most major opponents in

Asian trading on Thursday, the U.S. House of Representatives voted

to impeach President Donald Trump on grounds of misusing his powers

and obstructing the congressional probe into his dealings with

Ukraine.

Donald Trump becomes the third US president to be impeached by

the House of Representatives, after the impeachments of Bill

Clinton and Andrew Johnson.

Trump will now face a Senate trial next month.

However, removing the president from office requires a

two-thirds majority in the Senate, where the Republicans enjoy

control.

Investors await the U.S. Philadelphia Fed manufacturing survey,

weekly jobless claims and existing home sales due later in the day

for more direction.

The greenback traded mixed against its major rivals on

Wednesday. While it held steady against the yen and the franc, it

rose against the pound and the euro.

The greenback fell to 0.9797 against the franc, from a high of

0.9810 hit at 7:55 pm ET. The next possible support for the

greenback is seen around the 0.96 level.

The greenback pulled back to 109.56 against the yen, after

rising to a 3-day high of 109.68 at 7:50 pm ET. If the greenback

slides further, it may find support around the 106.00 level.

The Bank of Japan left its massive monetary stimulus unchanged,

as expected.

The central bank maintained the interest rate at -0.1 percent on

current accounts maintained by the financial institutions.

The greenback edged down to 1.1133 against the euro, following

an advance to 1.1112 at 5:00 pm ET. The greenback is seen locating

support around the 1.14 region.

The U.S. currency dropped to a 2-day low of 0.6881 against the

aussie, after having climbed to 0.6848 at 5:45 pm ET. On the

downside, 0.70 is possibly seen as the next support level for the

greenback.

Data from the Australian Bureau of Statistics showed that

Australia jobless rate fell a seasonally adjusted 5.2 percent in

November.

That was beneath expectations for 5.3 percent, which would have

been unchanged from the October reading.

In contrast, the greenback recovered to 1.3120 against the

loonie and 1.3077 against the pound, from its early lows of 1.3108

and 1.3091, respectively. The greenback is likely to challenge

resistance around 1.33 against the loonie and 1.27 against the

pound.

The greenback was steady against the kiwi, moving in the 0.6596

- 0.6576 range. At yesterday's close, the pair was worth

0.6588.

Looking ahead, Swiss trade data for November is due out at 2:00

am ET.

U.K. retail sales for November are slated for release in the

European session.

At 7:00 am ET, the Bank of England announces its interest rate

decision. Economists widely forecast the benchmark to remain at

0.75 percent and asset purchase program at GBP 435 billion.

In the New York session, Canada wholesale sales for October,

U.S. weekly jobless claims for the week ended December 14, existing

home sales and leading index for November will be featured.

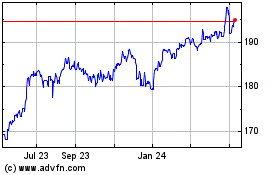

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024