RBA Leaves Interest Rate Unchanged At Record Low

December 03 2018 - 7:44PM

RTTF2

The Reserve Bank of Australia on Tuesday decided to keep its

benchmark interest rate unchanged at a record low, citing sluggish

wage growth and low inflation.

The board of the Reserve Bank of Australia, governed by Philip

Lowe, voted to maintain the cash rate at 1.50 percent. The interest

rate has remained at the current level since August 2016.

"Taking account of the available information, the Board judged

that holding the stance of monetary policy unchanged at this

meeting would be consistent with sustainable growth in the economy

and achieving the inflation target over time," the bank said in a

statement.

Policymakers observed that the low level of interest rates is

continuing to support the Australian economy.

They expect further progress in the reduction of unemployment

and inflation returning to target, but this progress is likely to

be gradual.

The Australian economy is performing well with the GDP growth

expected to average around 3.5 percent for this year and next, the

bank said.

Inflation is forecast to pick up in the coming years, but the

acceleration is likely to be gradual. The central scenario is for

inflation to be 2.25 percent in 2019 and a bit higher in the

following year.

Labor market remained strong with the unemployment rate

declining to 5 percent over the past year, the RBA noted. As the

economy is expected to continue to grow above trend, a further

reduction in the unemployment rate is likely, the bank added.

Concerning the property market, the RBA said conditions in the

Sydney and Melbourne housing markets have continued to ease and

nationwide measures of rent inflation remain low.

The outlook for household consumption remained a source of

uncertainty for the economy, the bank cautioned. Growth in

household income remains low, debt levels are high and some asset

prices have declined.

Growth in credit extended to owner-occupiers has eased, while

the demand by investors has slowed noticeably due to changing

dynamics of the housing market, it added.

The RBA statement sounded a little cautious by assessing

external conditions to be less favorable, Marcel Thieliant, an

economist at Capital Economics, said.

Thieliant suggested that the bank seemed to be getting a bit

more worried about the downturn in the housing market.

Given the dovish outlook for the economy and prices, the

economist said that rates are unlikely to rise until late in

2020.

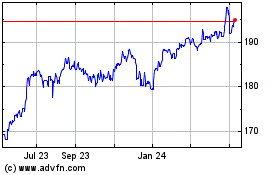

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024