U.S. Dollar Higher Before Fed Meeting

June 13 2021 - 9:28PM

RTTF2

The U.S. dollar appreciated against its most major counterparts

in the Asian session on Monday, as investors await monetary policy

decision from the Federal Reserve for guidance on its policy

action.

A two-day meeting of the Fed ends on Wednesday, with economists

expecting no change to rate and QE program.

The Fed funds rate stands at 0-0.25 percent and the quantitative

easing program at US$120 billion per month.

Investors will be watching Powell's remarks for indications

about the strength of the economic recovery and the timing of

tapering its asset purchase program.

A raft of Fed officials have suggested that the central bank

should at least begin discussions on tapering amid signs of a

pickup in economic activity.

This week's major economic reports include retail sales, PPI,

industrial production and housing market index due on Tuesday,

followed by housing starts and import prices on Wednesday. U.S.

weekly jobless claims may influence trading on Thursday.

The greenback rose to 0.8991 against the franc and 109.83

against the yen, off its prior lows of 0.8978 and 109.60,

respectively. The greenback is seen finding resistance around 0.92

against the franc and 112.00 against the yen.

The greenback reached as high as 1.2095 versus the euro, up from

a low of 1.2112 seen at 6:15 pm ET. The greenback is likely to test

resistance around the 1.18 level.

In contrast, the greenback weakened to 0.7712 against the

aussie, 0.7147 against the kiwi and 1.2149 against the loonie,

after falling to 0.7694, 0.7130 and 1.2168, respectively in early

deals. The next likely support for the greenback is seen around

0.80 against the aussie, 0.73 against the kiwi and 1.20 against the

loonie.

The greenback dropped to 1.4119 against the pound earlier in the

session and held steady thereafter. The pair had ended last week's

deals at 1.4111.

Looking ahead, at 2.30 am ET, Swiss producer and import prices

for May are due.

Eurozone industrial production for April will be released in the

European session.

Canada manufacturing sales for April are scheduled for release

in the New York session.

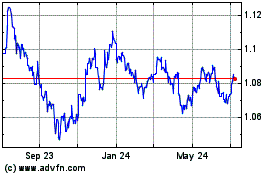

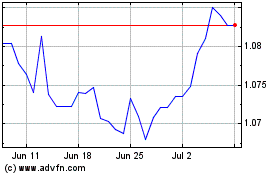

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024