Euro Lower After ECB Minutes

April 08 2021 - 6:42AM

RTTF2

The euro was weaker against its most major opponents in the

European session on Thursday, as the minutes from the European

Central Bank's March meeting showed that members broadly agreed

that a significant increase in the pace of its asset purchases was

warranted by the observed tightening of financing conditions and

the lack of a material improvement in the growth and inflation

outlook.

Policy makers expressed broad support for proposal to conduct

purchases under the PEPP over the next quarter at a significantly

higher pace than during the first few months of the year, the

minutes from the ECB's March 10-11 policy meeting showed.

Some policymakers argued that a more moderate increase in the

pace would better reflect the assessment of more balanced risks to

the outlook, also in the light of previous decisions when a similar

pace had been chosen but economic conditions had been worse.

"The Governing Council needed to avoid giving the impression of

being overly focused on sovereign yields or reacting mechanically

to a set of indicators of financing conditions," the minutes said.

There was wide agreement that the flexibility embodied in the PEPP

was symmetric, implying that the purchase pace could be increased

and decreased according to market conditions, the minutes

added.

ECB members agreed that the governing Council would undertake a

quarterly joint assessment of financing conditions and the

inflation outlook to determine the pace of purchases required to

keep financing conditions favourable.

Data from Destatis showed that Germany's factory orders growth

accelerated in February driven by domestic demand.

Factory orders grew 1.2 percent month-on-month in February,

faster than the 0.8 percent increase in January. The monthly growth

matched economists' expectations.

The euro showed a mixed trend against its major rivals in the

Asian session. While it fell against the yen, it was steady against

the pound and the franc. Versus the greenback, it climbed.

The euro fell to an 8-day low of 129.57 against the yen from

Wednesday's close of 130.37. The euro is seen finding support

around the 126.00 region.

Data from the Cabinet Office showed that Japan's consumer

confidence rose to the highest level in thirteen months in

March.

On a seasonally adjusted basis, the consumer confidence index

increased to 36.1 in March from 33.9 in February.

The euro declined to 1.1006 against the franc, its lowest level

since March 17. At Wednesday's close, the pair was valued at

1.1026. Should the euro slides further, 1.07 is likely seen as its

next support level.

The euro retreated to 0.8627 against the pound, after climbing

to 0.8657 at 4:45 am ET. The euro-pound pair had finished

yesterday's trading session at 0.8639. The euro may locate support

around the 0.84 level.

Survey data from IHS Markit showed that the UK construction

sector grew at the fastest pace since 2014 in March, underpinned by

strong rises in house building, commercial work and civil

engineering.

The Chartered Institute of Procurement & Supply construction

Purchasing Managers' Index rose to 61.7 in March from 53.3 in

February. This was the fastest expansion since September 2014.

The euro edged down to 1.6845 against the kiwi, compared to

Wednesday's close of 1.6914. The euro is likely to challenge

support around the 1.64 mark.

In contrast, the euro rebounded to 1.5580 against the aussie and

1.4996 against the loonie, from its prior lows of 1.5528 and

1.4945, respectively. Next key resistance for the euro is likely

seen around 1.57 against the aussie and 1.51 against the

loonie.

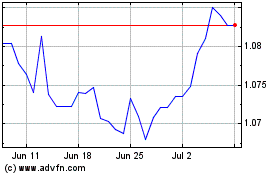

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

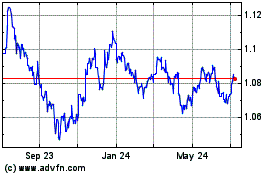

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024