Euro Mixed After ECB Maintains Rates, Pandemic Emergency Purchase Programme

October 29 2020 - 5:54AM

RTTF2

The euro came in mixed against its major counterparts during the

European session on Thursday, after the European Central Bank kept

its key interest rates and the size of the pandemic emergency

purchase programme unchanged as expected.

The Governing Council left the main refi rate at a record low of

zero percent and the deposit rate at -0.50 percent. The marginal

lending facility rate is at 0.25 percent. The decision was in line

with expectations.

The Governing Council will recalibrate its instruments if needed

in December, when the new round of oeconomic projections are

available.

The Governing Council is prepared to respond to the unfolding

situation and ensure that financing conditions remain favourable to

support the economic recovery and counteract the negative impact of

the pandemic on the projected inflation path.

"The Governing Council expects the key ECB interest rates to

remain at their present or lower levels until it has seen the

inflation outlook robustly converge to a level sufficiently close

to, but below, 2% within its projection horizon, and such

convergence has been consistently reflected in underlying inflation

dynamics," the bank said.

The Governing Council retained the pandemic emergency purchase

programme at EUR 1.35 trillion.

The ECB will also continue its asset purchases under the asset

purchase programme at a monthly pace of EUR 20 billion and an

additional EUR 120 billion temporary envelope until the end of this

year.

Survey results from European Commission showed that Eurozone

economic confidence stagnated in October as weaker sentiment in the

services sector and among consumers was offset by a recovery of

morale in industry, retail trade and construction.

The economic confidence index held steady at 90.9 in October.

The score was forecast to ease to 89.5.

During the Asian session, the currency showed mixed performance,

by rising against the yen but holding steady against the greenback

and the franc. Versus the pound, it dropped.

The euro was trading at 1.0684 against the franc, down from a

high of 1.0703 hit at 9:45 pm ET. The euro is seen finding support

around the 1.03 mark.

The euro fell to 1.1691 against the greenback, its lowest level

since October 15. Next key support for the euro is likely seen

around the 1.14 level.

The euro weakened to more than a 3-month low of 121.93 against

the yen and held steady afterwards. The euro is poised to challenge

support around the 119.00 mark.

Japan's central bank maintained its monetary policy easing as

widely expected, and cut its growth projections.

The Policy Board of the BoJ headed by Haruhiko Kuroda voted 8-1

to retain the interest rate at -0.1 percent on current accounts

that financial institutions maintain at the central bank.

The euro rebounded to 0.9050 against the pound, from a

1-1/2-month low of 0.9006 set at 5:30 am ET. The euro is likely to

face resistance around the 0.92 region, if it gains again.

Data from the Bank of England showed that UK mortgage approvals

rose to the highest level since late 2007 as the property market

continued to recover from the coronavirus driven downturn.

The number of mortgage approvals increased unexpectedly to

91,454 from 85,530 in the previous month. Approvals were forecast

to drop to 76,110.

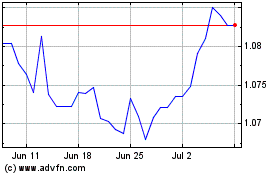

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

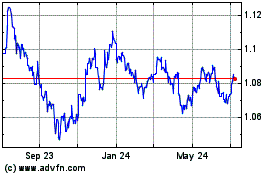

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024