Dollar Eases Off After In-line U.S. Retail Sales Data

February 14 2020 - 5:08AM

RTTF2

The U.S. dollar pulled back against its most major rivals in

early New York deals on Friday, following the release of the

nation's in line retail sales data for January.

Data from the Commerce Department showed that retail sales rose

in line with economist estimates in January.

The Commerce Department said retail sales rose by 0.3 percent in

January after edging up by a downwardly revised 0.2 percent in

December.

Economists had expected retail sales to climb by 0.3 percent,

matching the increase originally reported for the previous

month.

Excluding sales by motor vehicles and parts dealers, retail

sales still rose by 0.3 percent in January after climbing by 0.6

percent in December. Ex-auto sales were also expected to increase

by 0.3 percent.

Data from the Labor Department showed that U.S. import prices

came in flat in the month of January, while export prices

unexpectedly showed a notable rebound.

The Labor Department said import prices were unchanged in

January, while export prices climbed by 0.7 percent

Economists had expected import prices to dip by 0.2 percent.

The greenback fell to 1.0861 against the euro, from near a

3-year high of 1.0827 set at 7:00 pm ET. The greenback is seen

finding support around the 1.10 mark.

Preliminary figures from Destatis showed that German economy

stagnated in the fourth quarter of 2019 amid slower consumption and

weaker exports.

Gross domestic product was unchanged from the previous quarter

on a seasonally and calendar-adjusted basis. Economists had

forecast 0.1 percent growth.

The greenback pared gains to 109.74 against the yen, from a high

of 109.91 seen at 10:00 pm ET. The next possible support for the

greenback is seen around the 108.00 level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary industry activity declined unexpectedly in

December.

The tertiary industry activity index fell 0.2 percent

month-on-month in December. Economists had forecast a 0.1 percent

rise.

Having climbed to near a 2-month of 0.9819 at 8:15 am ET, the

greenback moved off to 0.9802 against the franc. On the downside,

0.96 is possibly seen as the next support level for the

greenback.

Data from the Federal Statistical Office showed that

Switzerland's producer and import prices declined in January.

The producer and import prices fell 1.0 percent year-on-year in

January.

In contrast, the greenback held steady against the pound, after

rising to 1.3001 at 8:15 am ET. The pair had finished Thursday's

trading at 1.3038.

The University of Michigan's preliminary consumer sentiment

index for February will be featured in the New York session.

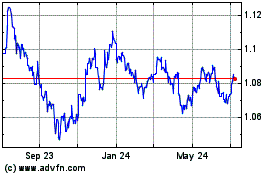

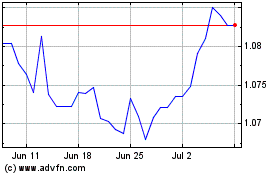

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024