Euro Mixed After Eurozone GDP Data

February 14 2020 - 1:39AM

RTTF2

The euro was trading mixed against its major counterparts in the

European session on Friday, after a data showed that the euro area

economy grew as initially estimated in the fourth quarter.

Flash estimates from Eurostat showed that gross domestic product

grew only 0.1 percent sequentially, following third quarter's 0.3

percent expansion. The rate came in line with the flash

estimate.

The 0.1 percent expansion was the slowest growth since early

2013.

On a yearly basis, economic growth eased to 0.9 percent from 1.2

percent in the third quarter. The fourth quarter growth was revised

down from 1 percent.

In the fourth quarter, the number of people in work increased at

a faster pace of 0.3 percent sequentially, faster than the 0.1

percent rise in the third quarter. On a yearly basis, employment

growth held steady at 1 percent.

Another report from Eurostat showed that the trade surplus

increased in December as exports increased from November, amid a

fall in imports.

The trade surplus rose to EUR 22.2 billion in December from EUR

19.1 billion in November. Exports grew 0.9 percent, while imports

fell 0.7 percent.

On an unadjusted basis, the trade surplus totaled EUR 23.1

billion versus EUR 16.3 billion a year ago. Exports advanced 4.8

percent and imports gained 1.1 percent annually.

Preliminary figures from Destatis showed that German economy

stagnated in the fourth quarter of 2019 amid slower consumption and

weaker exports.

Gross domestic product was unchanged from the previous quarter

on a seasonally and calendar-adjusted basis. Economists had

forecast 0.1 percent growth.

The currency showed mixed trading in the Asian session. While it

dropped against the greenback and the yen, it held steady against

the pound. Versus the franc, it rose.

The euro rose to a 2-day high of 1.0642 against the franc, after

falling to 1.0609, which was its lowest level since August 2015.

The next possible resistance for the euro is seen around the 1.08

area.

The euro bounced off to 1.0850 against the greenback, from near

a 3-year low of 1.0827 set at 7:00 pm ET. The euro may challenge

resistance around the 1.10 mark.

After dropping to a 4-month low of 118.87 in the Asian session,

the euro recovered to 119.14 against the yen. On the upside, 121.00

is likely seen as the next resistance for the euro.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary industry activity declined unexpectedly in

December.

The tertiary industry activity index fell 0.2 percent

month-on-month in December. Economists had forecast a 0.1 percent

rise.

The euro held steady against the pound, after reaching as high

as 0.8331 at 4:15 am ET. At yesterday's trading close, the pair was

valued at 0.8307.

Looking ahead, U.S. business inventories for December,

University of Michigan's preliminary consumer sentiment index for

February, retail sales, import and export prices and industrial

production, all for January, will be featured in the New York

session.

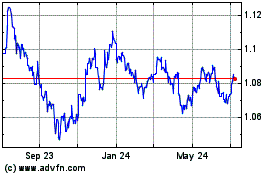

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

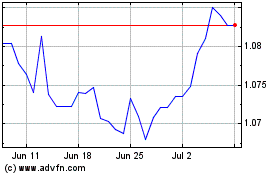

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024