Euro Spikes Up Amid ECB Lagarde's Testimony

December 02 2019 - 5:15AM

RTTF2

The euro appreciated against its most major counterparts in

early New York deals on Monday, after European Central Bank

President Christine Lagarde said that the central remained resolute

in its commitment to deliver on its price stability mandate.

Speaking before the European Parliament's economic affairs

committee, Lagarde said that the Governing Council's decisions in

September showed that it was alert to the potential side effects of

monetary policy.

The review of the ECB's monetary policy strategy will start in

the near future, the ECB chief told.

The strategy review will be guided by two principles - thorough

analysis and an open mind.

Neverthless, Eurozone growth remained weak mainly due to the

impact of global factors and there are signs of that the slowdown

in manufacturing is spreading to other sectors, Lagarde added.

Inflation remained subdued and price growth expectations are at

or close to historical lows, she said.

Final data from IHS Markit showed that the euro area

manufacturing sector continued to contract in November but the pace

of declined slowed from October.

The factory Purchasing Managers' Index improved to 46.9 in

November from 45.9 in October and above the flash 46.6.

Separate data showed that German PMI rose to a five-month high

of 44.1 in November from 42.1 in October. This was above the

preliminary estimate of 43.8.

The euro appreciated to a 10-day high of 1.1045 against the

greenback from last week's closing value of 1.1015. The euro may

find resistance around the 1.13 level.

The euro spiked up to 121.02 against the yen, its biggest since

November 7. If the euro rises further, 123.00 is likely seen as its

next resistance level.

The single currency approached a session's high of 0.8543

against the pound, after falling as low as 0.8514 at 7:00 am ET.

Next key resistance for the euro is seen around the 0.87 level.

The 19-nation currency that closed Friday's trading at 1.4627

against the loonie strengthened to a 10-day high of 1.4689. The

euro is seen finding resistance around the 1.49 level.

In contrast, the euro remained steady against the franc, after

touching a 5-day low of 1.0983 at 6:45 am ET. This may be compared

to nearly a 4-week high of 1.1028 hit at 7:45 pm ET. At Friday's

close, the pair was worth 1.1017.

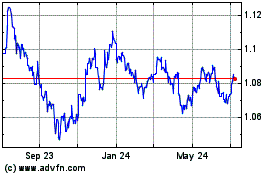

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

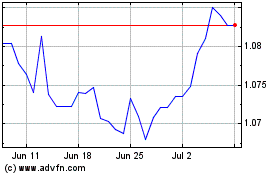

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024