Dollar Pulls Back As Soft Jobs Data Adds To Rate Cut Hopes

September 06 2019 - 6:13AM

RTTF2

The U.S. dollar moved off from its early highs against its major

counterparts in the European session on Friday, as U.S. job growth

accelerated less than forecast in August, supporting the likelihood

of an additional rate cut by the Federal Reserve this month.

Data from the Labor Department showed that the non-farm payroll

employment rose by 130,000 jobs in August after climbing by a

downwardly revised 159,000 jobs in July.

Economists had expected employment to increase by about 158,000

jobs compared to the addition of 164,000 jobs originally reported

for the previous month.

The Labor Department also said the unemployment rate held at 3.7

percent in August, unchanged from July and in line with economist

estimates.

Today's jobs data undermined optimism triggered by the

better-than-expected ISM nonmanufacturing gauge and the Automatic

Data Processing's private sector payrolls numbers for August on

Thursday.

Traders are also likely to keep an eye on remarks by Federal

Reserve Chairman Jerome Powell on the economy and monetary policy

at an event in Zurich.

The greenback showed mixed trading against its major

counterparts in the Asian session. While it held steady against the

euro and the yen, it rose against the franc. Against the pound, it

declined.

The greenback dropped to 0.6847 against the aussie, its weakest

level since August 1. Should the greenback slides further, 0.71 is

possibly seen as its next support level.

The greenback depreciated to more than a 2-week low of 0.6431

against the kiwi from Thursday's closing value of 0.6373. The

greenback is seen finding support around the 0.66 level.

The greenback slipped to more than a 4-week low of 1.3179

against the loonie, from a high of 1.3240 it recorded at 8:30 am

ET. The currency is likely to find support around the 1.30

level.

After rising to a 3-day high of 0.9918 against the franc at 7:30

am ET, the greenback eased off slightly to 0.9875. Next likely

support for the greenback is seen around the 0.97 level.

The greenback edged lower to 1.1055 against the euro, from a

high of 1.1020 seen at 7:30 am ET. Further downward trading may

take the greenback to a support around the 1.13 level.

Data from Destatis showed that Germany's industrial production

declined unexpectedly in July, adding fuel to worries that the

biggest euro area economy entered a recession in the third

quarter.

Industrial production fell 0.6 percent in July from June,

confounding expectations for an increase of 0.3 percent.

Nonetheless, the pace of decline slowed from the 1.1 percent fall

in June.

The greenback weakened to 106.65 against the yen, after having

climbed to 107.10 at 10:15 pm ET. The greenback is poised to

challenge support around the 104.00 level.

Preliminary data from the Cabinet Office showed that Japan's

leading index remained unchanged in July.

The leading index, which measures the future economic activity,

came in at 93.6 in July, unchanged from June. Economists had

forecast a reading of 93.2.

The greenback pulled back to 1.2336 against the pound, from a

high of 1.2285 it recorded at 4:45 am ET. Further downtrend is

likely to take the greenback to a support around the 1.27

level.

Survey data from IHS Markit and Lloyds Banking subsidiary

Halifax showed that UK house prices rose for a second straight

month in August, after stagnation in June, and the annual rate of

increase was the highest in four months.

The Halifax house price index rose 0.3 percent from July, when

they were 0.4 percent higher. Economists had forecast a 0.2 percent

increase.

Looking ahead, Canada Ivey PMI for August will be featured

shortly.

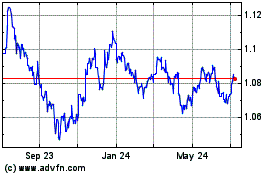

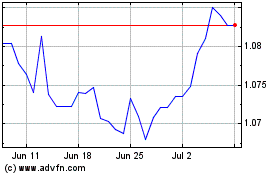

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024