China Central Bank Lowers Reserve Requirement Ratio Further

September 06 2019 - 4:17AM

RTTF2

China's central bank reduced further the amount of cash that

banks should set aside as reserves to spur liquidity in the economy

hit hard by trade wars.

The People's Bank of China decided to cut the reserve

requirement ratio, or RRR, by 50 basis points, which will take

effect on September 16, the bank said in a statement on Friday.

The bank resorted to its third reduction in RRR so far this year

as the economy struggles to maintain steady growth as trade

disputes with the US hurt the manufacturing sector.

In order to boost lending to small and medium-sized enterprises,

the reserve ratio of some commercial banks was lowered by 1

percentage point. The reduction will be implemented in two stages,

each time by 0.5 percentage points, first on October 15 and the

second on November 15.

The central bank said the RRR cut will release CNY 900 billion

liquidity into the financial system. The reduction is intended to

make funds available for lending and reduce the funding costs.

The RRR cut is not flooding the economy with stimulus and the

stable monetary policy orientation has not changed, the bank said

in a separate communique.

The announcement by the PBoC came after the State Council,

headed by Premier Li Keqiang on Wednesday, called for the "timely"

use of both broad and targeted RRR cuts to support the real

economy.

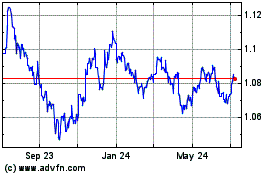

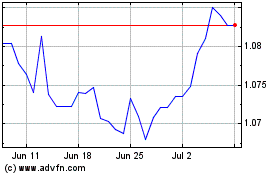

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024