NZ Dollar Weakens Ahead Of Central Bank Meetings

September 19 2022 - 12:24AM

RTTF2

The New Zealand dollar fell against its major counterparts in

the Asian session on Monday, as investors awaited meetings of major

central banks amid concerns about aggressive monetary policy

tightening to combat inflation.

The Federal Reserve will announce its interest rate decision on

Wednesday, with investors expecting an another 0.75 percentage

point rate hike.

The Bank of England and the Swiss National Bank will meet on

Thursday and the markets expect rate hikes of 75 basis points and

50 basis points, respectively.

The Bank of Japan is expected to maintain ultra-low interest

rates even as inflation picked up.

Investors fear that aggressive rate hikes by major central banks

could lead to a recession across the globe.

The kiwi dropped to 1.6761 against the euro and 1.1237 against

the aussie, down from its early highs of 1.6701 and 1.1201,

respectively. The next possible support for the kiwi is seen around

against the euro and against the aussie.

The kiwi weakened to 85.26 against the yen and 0.5949 against

the greenback, off an early high of 85.73 and a 4-day high of

0.6002, respectively. The kiwi may locate support around 83.00

against the yen and 0.57 against the greenback.

Looking ahead, Canada industrial product and raw materials price

indexes for August and U.S. NAHB housing market index for September

will be released in the New York session.

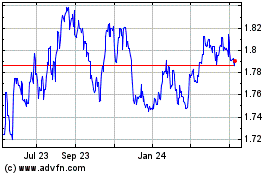

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

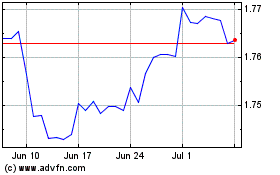

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024