Euro Higher On ECB Stimulus Boost

June 05 2020 - 12:10AM

RTTF2

The euro strengthened against its major rivals in the Asian

session on Friday, as European central bank announced a

bigger-than-expected expansion of its pandemic emergency purchase

program to help cushion a potential downturn caused by the virus

outbreak.

The ECB increased the size of its emergency asset purchase

programme, or PEPP, by EUR 600 billion to a total EUR 1,350

billion.

The program will run through at least the end of June 2021.

Maturing principal payments will be reinvested "until at least

the end of 2022".

ECB President Christine Lagarde said the bloc was experiencing

"an unprecedented contraction" and weak inflation.

"There has been an abrupt drop in economic activity as a result

of the coronavirus pandemic and the measures to contain it,"

Lagarde said.

Investors await the release of the closely-watched U.S. jobs

data for May later today.

Economists currently expect employment to tumble by about 8.0

million jobs in May after plunging by 20.5 million jobs in April.

The unemployment rate is expected to jump to 19.8 percent from 14.7

percent.

The euro firmed to a 5-month high of 1.0865 against the franc,

compared to yesterday's closing value of 1.0833. Should the

currency rallies again, 1.10 is possibly seen as its next

resistance level.

The euro rose to 1.1384 against the greenback, its biggest level

since March 10. The currency may test resistance around the 1.15

mark.

The single currency approached a 1-year high of 124.43 against

the yen from Thursday's closing quote of 123.72. The euro may find

resistance around the 127.00 region, if it rallies again.

Data from the Cabinet Office showed that the Japan leading index

declined to the lowest in eleven years.

The leading index, which measures the future economic activity,

fell to 76.2 in April from 85.1 in March. Economists had expected a

score of 84.5.

The EUR/CAD pair hit 1.5346, setting a weekly high. The currency

is poised to face resistance around the 1.55 mark.

In contrast, the euro edged down to 1.6207 against the aussie

and 1.7439 against the kiwi, from yesterday's closing values of

1.6330 and 1.7534, respectively. The euro is seen finding support

around 1.58 against the aussie and 1.66 against the kiwi. After

rising to 0.9005 at 11:15 pm ET, the euro dropped to 0.8953 against

the pound. On the downside, 0.86 is possibly seen as the next

support level for the currency.

Looking ahead, the U.S and Canadian jobs data and Canada Ivey

PMI, all for May, as well as U.S. consumer credit for April are due

in the New York session.

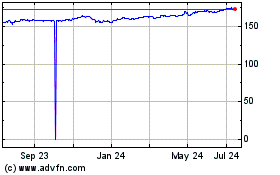

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

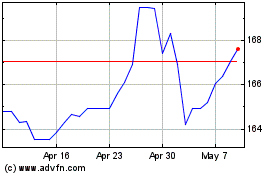

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024