Bank Of Japan Maintains Stimulus; Unveils Outline For Green Lending Facility

July 16 2021 - 12:55AM

RTTF2

The Bank of Japan decided to leave its monetary stimulus

unchanged and provided an outline for the new programme to support

efforts on climate change, through which the apex bank plans to

offer long-term loans at zero percent interest.

The central bank also lowered its near-term growth outlook

citing the impact of the coronavirus pandemic and raised its fiscal

2021 inflation forecast.

The board, governed by Haruhiko Kuroda, on Friday, voted 8-1, to

hold the interest rate at -0.1 percent on current accounts that

financial institutions maintain at the central bank.

The bank will continue to purchase a necessary amount of

Japanese government bonds without setting an upper limit so that

10-year JGB yields will remain at around zero percent.

The BoJ provided a preliminary outline for a new-funding

programme to support efforts in fields related to climate change.

The bank plans to launch the measure this year and to continue

until March 2031.

The BoJ has shifted from crisis mode towards addressing

long-term structural issues, Marcel Thieliant, an economist at

Capital Economics, said.

"With the vaccination program now at cruising speed, we suspect

that the Bank won't extend the deadline for its COVID-19 facilities

beyond March 2022," Thieliant added.

In the latest quarterly report, the bank forecast the economy to

expand 3.8 percent in the fiscal 2021 instead of 4 percent

estimated in April.

However, the outlook for the fiscal 2022 was lifted to 2.7

percent from 2.4 percent and the estimate for the fiscal 2023 was

retained at 1.3 percent.

Citing higher energy prices, the bank raised its inflation

forecast to 0.6 percent for the fiscal 2021 from 0.1 percent

projected previously.

Inflation forecast for the next fiscal was lifted marginally to

0.9 percent from 0.8 percent and the outlook for the fiscal 2023

was maintained at 1 percent.

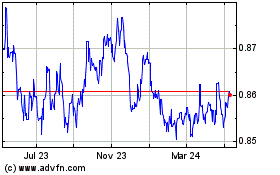

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

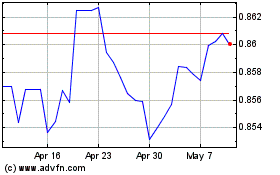

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024