Pound Rises As BoE Ramsden Downplays Prospect Of Negative Rate

September 28 2020 - 2:51AM

RTTF2

The pound was higher against its major counterparts in the

European session on Monday, as a Bank of England policymaker talked

down the likelihood of imminent negative interest rates and

investors await Brexit trade talks scheduled to resume this

week.

In a speech, BoE Deputy Governor Dave Ramsden said that the

slowdown in the economic activity was less severe than initially

expected in May.

The central bank expects GDP to recover steadily, although there

are real uncertainties and risks.

Strong data from China helped offset rising tensions between

Beijing and Washington.

Data from National Bureau of Statistics showed that China's

industrial profits grew for the fourth straight month in

August.

The pound advanced to near 3-week highs of 1.1944 against the

franc and 0.9043 against the euro, off its early lows of 1.1840 and

0.9119, respectively. The pound is likely to find resistance around

1.21 against the franc and 0.88 against the euro.

The pound climbed to a 10-day high of 135.83 against the yen and

a 1-week high of 1.2892 against the dollar, from its early lows of

134.36 and 1.2751, respectively. If the pound rises further, 138

and 1.31are possibly seen as its next resistance levels against the

yen and the dollar, respectively.

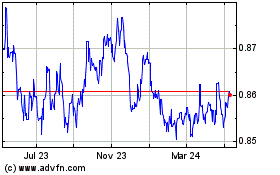

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

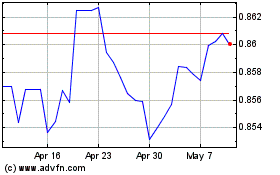

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024