Swiss Franc Appreciates On Weak China Data, Delta Virus Worries

August 16 2021 - 4:37AM

RTTF2

The Swiss franc was higher against its major opponents during

the European session on Monday amid risk aversion, as China data

signaled a slowdown in economic activity and investors assessed

risks of an outbreak of Delta variant of the new coronavirus on

fragile economic recovery.

Data from the National Bureau of Statistics showed that

industrial production growth slowed to 6.4 percent in July from 8.3

percent a month ago. Output was expected to gain 7.8 percent.

Retail sales grew at a slower pace of 8.5 percent on a yearly

basis, following a 12.1 percent rise in June. This was also weaker

than the economists' forecast of 11.5 percent.

Investors await minutes from the Fed's latest meeting to assess

whether a tapering announcement is edging closer.

Fed chair Jerome Powell will speak at a town hall event on

Tuesday, which could offer more signals about the possible timeline

for the tapering of the QE program.

The franc rose to 10-day highs of 0.9128 against the dollar and

1.2652 against the pound, off its early lows of 0.9164 and 1.2700,

respectively. The franc may locate resistance around 0.90 against

the dollar and 1.24 against the pound.

The franc touched a 1-week high of 1.0756 against the euro, up

from a low of 1.0804 seen at 11:30 pm ET. The franc is seen testing

resistance around the 1.05 level.

The franc rebounded to 119.87 against the yen, after touching

119.33, which was its lowest level since July 21. The franc is

likely to face resistance around the 121.00 mark.

Data from the Cabinet Office showed that Japan's gross domestic

product expanded an annualized 1.3 percent on year in the second

quarter of 2021.

That beat forecasts for an increase of 0.7 percent following the

3.9 percent contraction in the first quarter.

Looking ahead, Canada wholesale sales for June and New York

Fed's empire manufacturing survey for August will be featured in

the New York session.

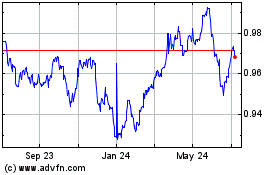

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

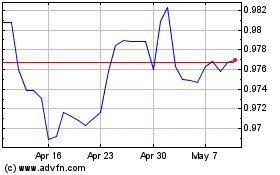

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024