Canadian Dollar Lower Before U.S. Inflation Data

October 13 2022 - 12:56AM

RTTF2

The Canadian dollar declined against its major counterparts on

Thursday, as oil prices fell ahead of U.S. inflation data that is

expected to support the likelihood of a 75-basis point rate hike

from the Federal Reserve next month.

The minutes from the Fed's September meeting showed that members

expect interest rates to remain high till prices come down and

choose to give priority to the commitment to reign in stubbornly

increasing inflation.

The minutes showed that many Fed officials "emphasized the cost

of taking too little action to bring down inflation likely

outweighed the cost of taking too much action."

Overnight data showed that U.S. producer prices climbed more

than expected in September.

On a yearly basis, producer prices rose 8.5 percent in September

versus expectations for an increase of 8.4 percent.

The Labor Department releases the consumer price index report

for September at 8:30 am ET. Economists expect annual inflation to

ease to 8.1 percent from 8.3 percent, but the core reading is seen

accelerating to 6.5 percent from 6.3 percent in the previous

month.

The loonie was down against the euro, at 1.3420. The loonie is

likely to challenge support near the 1.36 mark.

The loonie was trading at a 2-day low of 1.3837 against the

greenback. Should the loonie falls further, it is likely to test

support around the 1.41 region.

The loonie fell to a 2-day low of 0.8684 against the aussie

around 9:50 pm ET and held steady thereafter. At yesterday's

trading close, the pair was quoted at 0.8669.

The loonie edged down to 106.10 against the yen, from a high of

106.37 set at 8:50 pm ET. The loonie is seen finding support around

the 96.00 mark.

Looking ahead, U.S. weekly jobless claims for the week ended

October 8 and consumer inflation data for September will be

published in the New York session.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

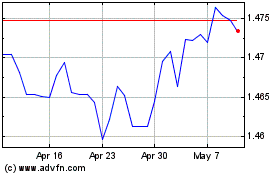

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024