Australian, NZ Dollars Higher After China Rate Cuts

August 22 2022 - 12:59AM

RTTF2

The Australian and NZ dollars moved up against their major

counterparts in the Asian session on Monday, following China's

reduction in benchmark lending rates to prevent a slowdown in

economic growth.

The one-year loan prime rate was reduced by 5 basis points to

3.65 percent and the five-year LPR was cut by 15 basis points to

4.30 percent.

The Federal Reserve's Jackson Hole Symposium is due this week,

where policymakers are expected to strike hawkish tone on future

rate hikes.

Federal Reserve Chair Jerome Powell will speak at the Jackson

Hole meeting on Friday.

Investors will be watching Powell's speech for hints about

future rate hikes and monetary policy outlook.

The aussie rose to 0.6906 against the greenback, off an early

low of 0.6868. If the aussie rises further, it may find resistance

around the 0.72 level.

The aussie firmed to a 1-week high of 94.84 against the yen and

a 5-day high of 1.4506 against the euro, up from its early lows of

93.96 and 1.4609, respectively. The next possible resistance for

the aussie is seen around 96.00 against the yen and 1.41 against

the euro.

The aussie touched a 4-day high of 0.8974 against the loonie,

from an early nearly 3-week low of 0.8913. The aussie is seen

finding resistance around the 0.92 level.

The NZ currency appreciated to 0.6208 against the greenback,

85.17 against the yen and 1.6142 against the euro, after falling to

0.6167, 84.41 and 1.6268, respectively in early deals. The kiwi is

poised to find resistance around 0.64 against the greenback, 86.5

against the yen and 1.59 against the euro.

The kiwi recovered to 1.1118 against the aussie, from an early

nearly 4-week low of 1.1149. The kiwi is likely to challenge

resistance around the 1.10 level.

Looking ahead, Canada new housing price index for July is

scheduled for release in the New York session.

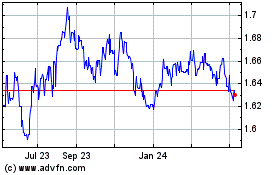

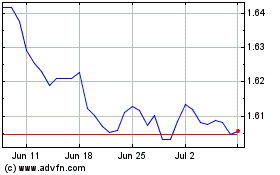

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024