Euro Depreciates On U.S.-China Tensions

August 27 2020 - 3:26AM

RTTF2

The euro drifted lower against its major counterparts in the

European session on Thursday amid risk aversion, as tensions

escalated between the U.S. and China over the South China.

While the United States blacklisted 24 Chinese firms and

targeted individuals it said were part of construction and military

actions in the South China Sea, Beijing fired four missiles into

the world's most hotly contested body of water, further ratcheting

up tensions between the two countries.

Traders also waited for Fed Chairman Jerome Powell's speech at

the annual central bankers' conference later in the day for clues

about whether a shift to easier policy is possible in coming

months.

Analysts expect that Powell will outline dovish measures

including a move toward average inflation targeting in which

inflation above the central bank's usual 2 percent target would be

tolerated and even desired.

The euro weakened to 1.1810 against the greenback from a 3-day

high of 1.1850 seen at 9:00 pm ET. On the downside, support is seen

near the 1.15 level.

The euro declined to a 6-day low of 0.8944 against the pound and

a 2-day low of 125.18 against the yen, after rising to 0.8965 and

125.62, respectively in early deals. The euro is likely to face

support around 0.86 against the pound and 120.00 against the yen,

if it falls again.

The EUR/CHF pair hit 1.0730, its weakest level since July 27.

Next key support for the euro is likely seen around the 1.05

level.

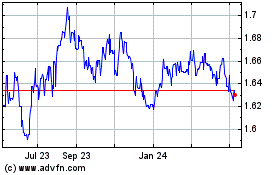

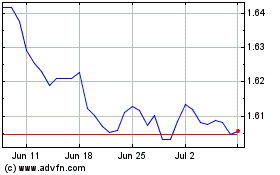

The euro slipped to a 5-week low of 1.6290 against the aussie

and more than a 2-week low of 1.7805 versus the kiwi, off its early

highs of 1.6363 and 1.7885, respectively. The euro is poised to

challenge support around 1.59 against the aussie and 1.70 versus

the kiwi.

After an early gain to 1.5582 against the loonie, the euro

turned lower and was trading at 1.5527. Immediate support for the

euro may be found around the 1.52 level.

Looking ahead, U.S. GDP data for second quarter, weekly jobless

claims for the week ended August 22 and pending home sales for July

will be featured in the New York session.

At 9:10 am ET, Federal Reserve Chair Jerome Powell will deliver

a speech titled "Monetary Policy Framework Review" at the Jackson

Hole Economic Policy Symposium, via satellite.

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024