Euro Climbs On ECB Stimulus Hopes, Positive China Data

June 03 2020 - 3:23AM

RTTF2

The euro spiked up against its major rivals in the European

session on Wednesday, as investors await more stimulus from the

European Central Bank and encouraging services sector data from

China and Europe bolstered risk sentiment.

The services Purchasing Managers' Index for China advanced to

55.0 in May from 44.4 in April, signaling a recovery in the sector.

The pace of expansion was the steepest since October 2010.

The euro zone services purchasing managers index rose to 30.5 in

May from 12 in April, above the flash reading of 28.7 and a

three-month high.

The European Central Bank's policy decision is due on Thursday.

Economists expect the ECB to boost the pandemic emergency purchase

program by 500 billion euros, bringing it to 1.25 trillion

euros.

Data from Eurostat showed that the euro area unemployment rate

increased in April as member countries implemented coronavirus, or

Covid-19, containment measures.

The jobless rate rose to 7.3 percent in April from 7.1 percent

in March. But this was below economists' forecast of 8.2

percent.

Data from the Federal Labor Agency showed that German

unemployment increased more than expected in May amid coronavirus

pandemic.

The number of people out of work increased by 238,000 from the

previous month to 2.875 million in May. Economists had forecast an

increase of 200,000.

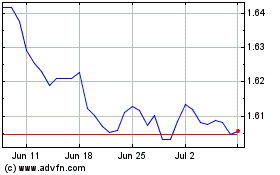

The euro recovered to 1.7569 against the kiwi and 1.6276 against

the aussie, from more than a 3-month low of 1.7407 and a 5-month

low of 1.6033, respectively seen in the Asian session. The next

possible resistance for the euro is seen around 1.78 against the

kiwi and 1.65 against the aussie.

The euro approached a 2-day high of 1.5170 against the loonie,

after falling to 1.5092 at 5:00 pm ET. On the upside, 1.54 is

possibly seen as the next resistance level for the euro.

The euro firmed to a 2-1/2-month high of 1.1228 against the

greenback, 4-1/2-month highs of 122.08 against the yen and 1.0799

against the franc, from its prior lows of 1.1167, 121.27 and

1.0741, respectively. The euro is likely to find resistance around

1.14 against the greenback, 125.00 against the yen and 1.10 against

the franc.

The euro reversed from an early low of 0.8878 against the pound,

with the pair trading at 0.8878. Next likely resistance for the

euro is seen around the 0.92 mark.

Looking ahead, U.S. ADP private payrolls data for May is

scheduled for release at 8:15 am ET.

At 10:00 am ET, the Bank of Canada announces decision on

interest rates. Economists forecast the benchmark rate to remain at

0.25 percent.

In the New York session, U.S. ISM services PMI for May and

factory orders for April are set for release.

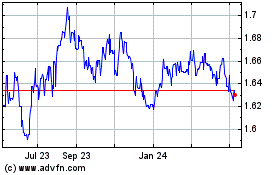

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024