Australian And NZ Dollars Advance On Coronavirus Drug Hopes

April 29 2020 - 10:58PM

RTTF2

The Australian and NZ dollars drifted higher against their major

counterparts in the Asian session on Thursday, as promising trial

results of Gilead Sciences' potential coronavirus treatment

remdesivir boosted investor sentiment.

Gilead Sciences cited positive data emerging from the National

Institute of Allergy and Infectious Diseases' study of its

investigational antiviral remdesivir for the treatment of COVID-19.

The company said the trial met its primary endpoint and that NIAID

will provide detailed information at an upcoming briefing.

Gilead Sciences also announced positive data from a phase 3

trial evaluating 5-day and 10-day dosing durations of Remdesivir in

hospitalized patients with severe COVID-19 infection with evidence

of pneumonia and reduced oxygen levels.

Data from the Australian Bureau of Statistics showed that

Australia export prices rose 2.7 percent on quarter and 2.3 percent

on year.

Main contributors to the rise were: Gold, non-monetary

(excluding gold ores and concentrates) (+11.4 percent);

Metalliferous ores and metal scrap (+2.3 percent); Gas, natural and

manufactured (+4.3 percent); and Meat and meat preparations (+4.0

percent).

The aussie climbed to near 2-month highs of 0.6570 against the

greenback and 69.95 against the yen, reversing from its early lows

of 0.6429 and 69.73, respectively. The aussie is seen finding

resistance around 0.70 against the greenback and 74.00 against the

yen.

The aussie recovered to 0.9106 against the loonie, from a 2-day

low of 0.9071 hit at 9:00 pm ET. On the upside, 0.93 is possibly

seen as the next resistance level for the aussie.

The aussie appreciated to more than a 2-month high of 1.6539

against the euro, after falling to 1.6627 at 9:30 pm ET. Further

uptrend may take the aussie to a resistance around the 1.60

level.

The kiwi firmed to near a 2-month high of 1.7661 against the

euro, more than 6-week high of 0.6149 against the greenback and a

10-day high of 65.51 against the yen, from its previous lows of

1.7755, 0.6117 and 65.29, respectively. The next possible

resistance for the kiwi is seen around 1.70 against the euro, 0.65

against the greenback and 69.00 against the yen.

The kiwi rose to a 3-day high of 1.0670 against the aussie and

held steady thereafter. The pair closed yesterday's deals at

1.0688.

Looking ahead, German jobless rate and Swiss KOF leading

indicator for April, Eurozone inflation for the same month, jobless

rate for March and GDP data for the first quarter are due in the

European session.

At 7:45 am ET, the European Central Bank announces its decision

on interest rates. Economists expect the refi rate and the marginal

lending facility rate to be kept at 0.00 percent and -0.50 percent,

respectively.

In the New York session, Canada GDP data for February and

industrial product price index for March, as well as U.S. weekly

jobless claims for the week ended April 24 and personal income and

spending data for March are slated for release.

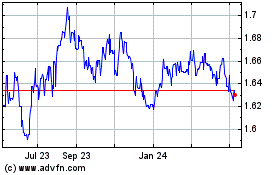

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

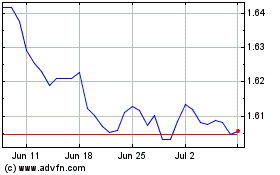

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024