China's Industrial Output Growth Improves Less Than Expected

June 14 2020 - 10:34PM

RTTF2

China's industrial production grew at a weaker than expected

pace and retail sales decreased at a slower rate suggesting a slow

recovery from the coronavirus crisis.

Data from the National Bureau of Statistics showed that

industrial production grew 4.4 percent on a yearly basis in May,

faster than the 3.9 percent increase logged in April but slower

than economists' forecast of 5 percent rise.

Retail sales dropped at a slower pace of 2.8 percent in May from

last year, slower than the 7.5 percent decrease seen in April.

However, the decline was faster than the expected fall of 2

percent.

During January to May, fixed asset investment decreased 6.3

percent from the same period of last year after easing 10.3 percent

in January to April period. Economists had forecast a 5.9 percent

fall.

The surveyed unemployment rate dropped marginally to 5.9 percent

in May from 6 percent a month ago.

The statistical office said the overseas epidemic situation and

global economic conditions have become more severe and complicated,

and the stable operation of the domestic economy still faces many

risks and challenges.

The economy is recovering, albeit slowly, Iris Pang, an ING

economist said. However, the economist forecasts the economy to

shrink 3.1 percent in the second quarter and 1.5 percent fall in

the whole year of 2020, unchanged from the previous

projections.

Pang said unstable job market and healthcare concerns are the

main factors slowing down the recovery.

Further, data showed that house prices increased 0.7 percent in

the first tier cities in May. Prices in second-tier cities were up

0.6 percent and rose 0.7 percent in third-tier cities.

The People's Bank of China injected CNY 200 billion funds into

the financial system via medium-term lending facility at a rate of

2.95 percent, unchanged from the previous operation.

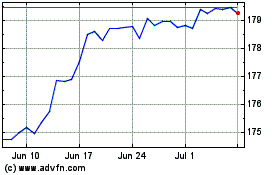

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024