Japanese Yen Extends Drop On Stimulus Hopes

March 10 2020 - 5:42AM

RTTF2

The Japanese yen extended decline against its major trading

partners in the European session on Tuesday, as hopes for

coordinated policy actions from central banks around the world

helped ease worries about the economic impact of the coronavirus

outbreak.

European stocks rose sharply following U.S. President Donald

Trump's announcement that the administration is considering "major"

steps to protect the economy from possible damage due to the

outbreak.

Trump said that he would hold a meeting with Senate and House

Republicans to discuss a payroll tax cut and "very substantial

relief" for industries that have been hit by the virus.

Trump has scheduled a news conference later today, when he will

outline economic stimulus plans in response to the virus.

The Japanese government approved a financial aid package worth

1.1 trillion yen ($10.7 billion) for small and medium-sized

enterprises which need financing over the next two to three

weeks.

Data from the Bank of Japan showed that Japan M2 money stock

rose 3.0 percent on year in February - coming in at 1,039.8

trillion yen.

That follows the 2.8 percent increase in January.

The yen fell to a 4-day low of 105.22 against the greenback,

after rising to 102.00 at 6:00 pm ET. The yen may locate support

around the 108.00 level.

The yen was down at a 4-day low of 119.35 against the euro,

reversing from a high of 116.81 seen at 6:00 pm ET. The yen is

likely to challenge support around the 120.00 mark.

Data from Eurostat showed that the euro area economy expanded at

a slower pace as initially estimated at the end of 2019 driven by

weaker consumption and exports.

Gross domestic product in the 19-nation bloc grew only 0.1

percent sequentially in the fourth quarter, following third

quarter's 0.3 percent expansion.

After climbing to 110.15 at 6:00 pm ET, the yen turned negative,

touching a 4-day low of 112.47 versus the franc. The next immediate

support for the yen is seen around the 114.00 level.

The yen was lower at a 4-day low of 137.21 versus the pound,

down from a high of 133.71 it recorded at 6:00 pm ET. If the yen

slides further, 140.00 is likely seen as its next support

level.

Data from the British Retail Consortium and KPMG showed that UK

like-for-like retail sales declined in February despite rising

consumer confidence.

Like-for-like sales fell 0.4 percent annually in February,

confounding expectations for an increase of 0.4 percent.

The Japanese currency reached as low as 68.99 against the

aussie, pulling back from a high of 67.23 it set at 6:00 pm ET. The

yen is seen finding support around the 71.00 region.

Survey data from the National Australia Bank showed that

Australia business confidence and conditions weakened in February,

although it appears too early to fully quantify the effect of the

Coronavirus.

The business conditions index fell two points to zero in

February, led by a decline in profitability and small decline in

trading conditions.

The yen fell to its lowest since November 2016 against the

loonie, at 77.14, in the previous session and has stabilized

thereafter. The pair had ended Monday's deals at 74.70.

The yen dipped to a multi-year low of 66.37 against the kiwi,

following an advance to 64.69 at 6:00 pm ET. Further decline in the

currency is likely to see support around the 68.00 level.

Data from Statistics New Zealand showed that the volume of

manufacturing activity in New Zealand was up a seasonally adjusted

2.7 percent on quarter in the fourth quarter of 2019 - following

the flat September quarter.

The main industry movements were meat and dairy products, up 7.9

percent; petroleum and coal products, up 12 percent; and transport

equipment, machinery and equipment, up 3.9 percent.

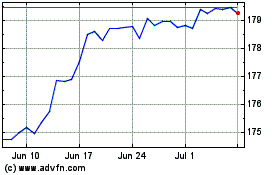

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024