UK House Price Inflation At 18-month High - Nationwide

February 27 2020 - 9:36PM

RTTF2

UK house price inflation was the highest in 18 months in

February, survey data from the Nationwide Building Society showed

on Friday. The house price index rose 2.3 percent year-on-year

after a 1.9 percent increase in January. The figure was in line

with economists' expectations. The latest house price inflation was

the highest since July 2018, when it was 2.5 percent. The average

house price rose to GBP 216,092 from GBP 215,897 in the previous

month. "While overall economic growth ground to a halt in the final

three months of 2019, labor market conditions remained buoyant and

borrowing costs low," Nationwide Chief Economist Robert Gardner

said. "The decisive election outcome may have provided a boost to

buyer sentiment."

On a month-on-month basis, house prices rose 0.3 percent after a

0.5 percent increase in January. Economists had expected a 0.4

percent climb. On a three months-on-three months basis, house

prices rose 1 percent in February. Citing recent business surveys,

Gardner said these suggest economic activity recovered in the New

Year. That said, there are still significant uncertainties that

threaten to exert a drag on the economy in the coming quarters, the

economist added. "The global economic backdrop remains challenging,

with the coronavirus outbreak expected to weigh on global activity

in the coming quarters," Gardner said. "Investment is likely to

remain subdued until the UK's future global trading relationships

become clearer, which is unlikely until early next year."

Nationwide expects the UK economy to continue to expand at a

modest pace in 2020, with house prices remaining broadly flat.

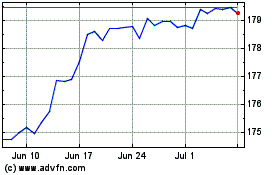

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024