Yen Trades Higher After Trump's Tariff Move On Mexico

May 31 2019 - 6:22AM

RTTF2

The Japanese yen traded higher against its major counterparts in

the European session on Friday, as U.S. President Donald Trump's

threat to impose tariffs on Mexican goods as well as weak Chinese

manufacturing data sparked risk aversion.

Trump on Thursday announced new tariffs on all goods coming from

Mexico to curb illegal immigration across the border to the

U.S.

In a tweet, Trump said that from 10 June a 5 percent tariff

would be imposed and would slowly rise until the situation is

resolved.

Trump latest announcement came on the heels of persistent trade

tensions with China, further exacerbating growth concerns.

China's manufacturing activity declined in May for the first

time in three months amid ongoing trade spat with the U.S, official

data showed.

Risk sentiment took a hit, triggering a rally in safe havens

such as U.S. and German bonds, the Japanese yen and gold.

Data from the Ministry of Land, Infrastructure, Transport and

Tourism showed that Japan's housing starts declined for the first

time in five months in April.

Housing starts dropped 5.7 percent year-on-year in April, after

a 10.0 percent increase in March. Economists had forecast the

housing starts to fall 0.8 percent. This was the first decline

since December.

The currency has been trading in a positive territory against

its major rivals in the Asian session.

The yen firmed to a 5-month high of 108.71 against the greenback

and a 3-week high of 108.09 against the franc, from Thursday's

closing values of 109.62 and 108.75, respectively. The next

possible resistance for the yen is seen around 106.00 against both

the greenback and the franc.

The yen that closed yesterday's trading at 122.00 against the

euro and 138.19 against the pound strengthened to near 5-month

highs of 121.17 and 136.63, respectively. If the yen rallies

further, 118.00 and 133.00 are possibly seen as its next resistance

levels against the euro and the pound, respectively.

The Japanese yen also moved up to near 5-month highs of 75.09

against the aussie, 80.16 against the loonie and 70.68 against the

kiwi, compared to yesterday's closing values of 75.77, 81.21 and

71.36, respectively. The yen is seen finding resistance around 73.5

against the aussie, 78.5 against the loonie and 69.0 against the

kiwi.

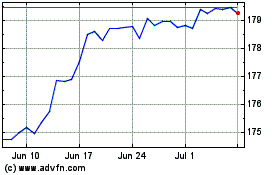

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024