Yen Weakens Amid Macron's Lead, Fed Rate Hike Expectations

April 11 2022 - 1:00AM

RTTF2

The Japanese yen slipped against its major rivals in the

European session on Monday, as uncertainty over French presidential

elections eased after Emmanuel Macron got a lead in the first round

and investors awaited U.S. inflation data that is expected to

support aggressive interest rate hikes in the coming months.

Macron won 27.6 percent of the vote in the first round and

far-right nationalist Marine Le Pen got 23.4 percent of the vote,

setting stage for a run off in the second round of election.

Macron's victory is perceived as positive for markets, given his

support for NATO and close ties with the European Union.

The U.S. consumer price index is due on Tuesday, with economists

expecting a rise of 8.5 percent on year.

Core inflation is seen rising to 6.6 percent from 6.4 percent in

February, which would be the highest reading since 1982.

The yen fell to near 7-year lows of 125.44 against the greenback

and 134.05 against the franc, off its early highs of 124.01 and

132.83, respectively. The next possible support for the yen is seen

around 128.00 against the greenback and 136.00 against the

franc.

The yen depreciated to near a 2-week low of 136.61 against the

euro and a 2-week low of 163.10 against the pound, after rising to

135.27 and session's high of 161.64, respectively in early deals.

The currency is likely to find support around 138.00 against the

euro and 167.00 against the pound.

The yen weakened to a 5-day low of 93.22 against the aussie and

a 4-day low of 85.67 against the kiwi, down from its prior highs of

92.42 and 84.95, respectively. If the yen extends drop, 96.00 and

88.00 are possibly seen as its next support levels against the

aussie and the kiwi, respectively.

The yen touched 99.52 against the loonie, its lowest level since

March 28. On the downside, 102.00 is possibly seen as its next

support level.

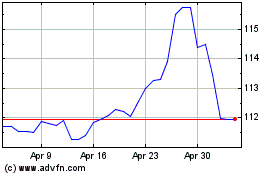

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

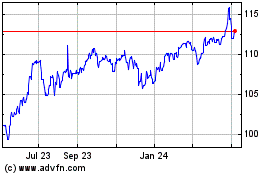

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024