Canadian Dollar Appreciates As Inflation Surges

February 16 2022 - 5:09AM

RTTF2

The Canadian dollar spiked up against its most major rivals in

the New York session on Wednesday, as a data showed that the

nation's annual inflation accelerated to a fresh 30-year high in

January.

Data from Statistics Canada showed that the consumer price index

rose 5.1 percent on a year-over-year basis in January, up from a

4.8 percent gain in December. This was the highest inflation rate

since September 1991. Economists had expected a 4.8 percent

increase.

On a seasonally adjusted monthly basis, the CPI climbed to 0.6

percent from 0.3 percent in December.

Core CPI, excluding food and energy, grew 0.4 percent from 0.3

percent last month.

The loonie firmed to 1.2663 against the greenback, its strongest

level since February 10. The loonie is seen facing resistance

around the 1.25 level.

The loonie edged up to 1.4388 against the euro, from a low of

1.4459 hit at 2:45 am ET. If the loonie rises further, 1.42 is

likely seen as its next resistance level.

The loonie rebounded to 0.9074 against the aussie, after

declining to a 5-day low of 0.9117 in the previous session. The

loonie may challenge resistance around the 0.89 level.

In contrast, the loonie pulled back to 90.94 against the yen,

from a 5-day high of 91.40 it touched immediately following the

data. The next likely support for the currency is seen around the

88.00 level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary activity rose at a softer pace in

December.

The tertiary activity index rose 0.4 percent month-on-month in

December, after 0.7 percent increase in November.

Looking ahead, the Fed minutes from the January 25-26 meeting

are set for release at 2:00 pm ET.

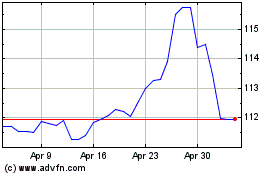

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

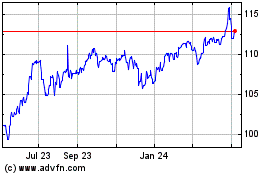

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024