Japanese Yen Falls Amid Rising Risk Appetite

February 09 2022 - 10:23PM

RTTF2

The Japanese yen slipped against its major rivals in the Asian

session on Thursday, as most Asian stocks climbed, following the

broadly positive cues overnight from Wall Street, led by a rally in

tech stocks and strong earnings.

Investors awaited a key report on U.S. inflation for more

indications about the pace of tightening of monetary policy by the

Federal Reserve.

The CPI is expected to rise by 7.3 percent on an annual basis in

January, marking the highest reading seen since 1982.

A strong reading could put pressure on the Fed to raise rates

more aggressively and at a faster pace than projected.

Speaking on CNBC's "Squawk Box," Atlanta Federal Reserve

President Raphael Bostic said that he expects inflation to ease

soon and that a three or four rate hike hikes may be appropriate

for this year.

The yen dropped to 132.15 against the euro, 156.60 against the

pound and 125.18 against the franc, off its early highs of 131.87,

156.19 and 124.81, respectively. The yen is poised to challenge

support around 134.00 against the euro, 160.00 against the pound

and 128.00 against the franc.

The yen touched 115.71 versus the greenback, its lowest level

since January 10. On the downside, support is seen near the 118.00

level.

The yen weakened to near a 4-week low of 83.07 against the

aussie and near a 3-week low of 91.28 against the loonie, after

gaining to 82.73 and 91.03, respectively in early trades. Immediate

support for the yen may be found around 86.00 against the aussie

and 93.00 against the loonie.

The yen dropped to 77.43 versus the kiwi, hitting a 3-week low.

If the yen extends drop, 80.00 is possibly seen as its support

level.

Looking ahead, U.S. weekly jobless claims for the week ended

February 5, inflation data and monthly budget statement for January

are scheduled for release in the New York session.

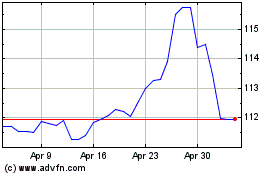

CAD vs Yen (FX:CADJPY)

Forex Chart

From Mar 2024 to Apr 2024

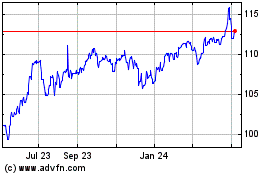

CAD vs Yen (FX:CADJPY)

Forex Chart

From Apr 2023 to Apr 2024