Australian Dollar Firms After RBA Decision

July 05 2021 - 10:02PM

RTTF2

The Australian dollar climbed against its most major

counterparts in the Asian session on Tuesday, after the Reserve

Bank of Australia left its cash rate unchanged and said it will

continue its bond buying program when it ends in early

September.

The Reserve Bank of Australia maintained its cash rate and the

three-year government bond yield target at 0.1 percent, as

expected.

The central bank will retain the April 2024 bond as the bond for

the 3-year yield target.

The QE programme was extended at a rate of $4 billion a week

until at least mid November. The current bond purchase program will

end in early September.

The RBA reiterated that it will not increase the cash rate until

actual inflation is sustainably within the 2 to 3 percent target

range. The Bank's central scenario for the economy is that this

condition will not be met before 2024.

The aussie climbed to 8-day highs of 0.7572 against the

greenback and 83.93 against the yen, from its early lows of 0.7524

and 83.47, respectively.

Reversing from its previous lows of 1.5756 against the euro and

0.9282 against the loonie, the aussie rose to near a 4-week high of

1.5680 and a 1-week high of 0.9334, respectively.

The currency is likely to locate resistance around 0.78 against

the greenback, 86 against the yen, 1.54 against the euro and 0.96

against the loonie.

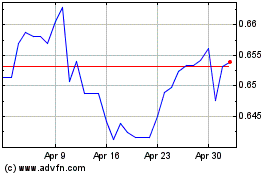

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

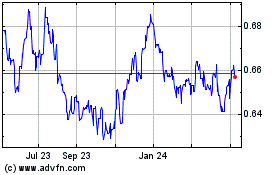

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024