U.S. Dollar Slides As Yuan Stabilization Improves Sentiment

August 08 2019 - 3:10AM

RTTF2

The U.S. dollar fell against its major counterparts in early

European deals on Thursday, as investor sentiment lifted up after

China limited the decline of the yuan, while expectations for

additional Fed rate cuts rose following comments from Chicago Fed

President Charles Evans.

Stronger-than-expected reference rate for the yuan lessened

fears about the U.S-China trade war. The exchange rate also

steadied following Monday's decline that rattled financial

markets.

Solid trade data from China also lifted sentiment.

Official data showed that China's exports rose 3.3 percent

year-over-year in July, defying expectations for a fall of 1

percent. Imports fell 5.6 percent, while economists had predicted a

decline of 9.0 percent.

Consequently, trade surplus rose to $45.06 billion versus

forecasts for $42.65 billion.

Evans remarked on Wednesday that "more policy accommodation" was

needed to support inflation and stem risks to economic growth from

trade tensions.

Investors are pricing in three additional rate cuts by the

Federal Reserve by the year end to avoid a recession.

The greenback was trading at 106.11 against the yen, after

having retreated from a high of 106.30 hit at 9:15 pm ET. If the

greenback falls further, 101.00 is likely seen as its next support

level.

The greenback edged down to 0.9738 against the franc and held

steady thereafter. On the downside, 0.96 is possibly seen as the

next support level for the greenback.

The greenback fell to 1.1228 against the euro from a high of

1.1197 hit at 5:00 pm ET. The currency is likely to face support

around the 1.14 level.

The greenback reached as low as 1.2182 against the pound, down

from Wednesday's closing value of 1.2140. The greenback is poised

to find support around the 1.27 region.

The greenback depreciated to a 2-day low of 0.6790 against the

aussie from yesterday's closing value of 0.6756. The greenback is

seen finding support around the 0.70 level.

The greenback held steady against the kiwi, after dropping to

0.6469 in the Asian session. The pair was valued at 0.6445 at

yesterday's close.

On the flip side, the greenback ticked up to 1.3301 against the

loonie, from a low of 1.3272 seen at 9:30 pm ET. The next possible

resistance for the greenback is seen around the 1.35 level.

Looking ahead, Canada new housing price index for June, U.S.

weekly jobless claims for the week ended August 3 and wholesale

inventories for June will be out in the New York session.

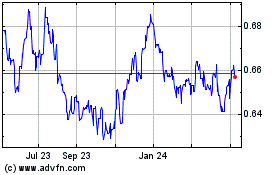

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

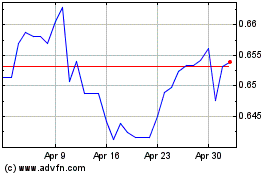

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024