U.S. Dollar Higher On US-China Trade War Fears

October 30 2018 - 6:07AM

RTTF2

The U.S. dollar was higher against its major counterparts in the

European session on Tuesday, as investors fret over the impact of

U.S.-China trade war, following a media report that the Trump

administration is preparing tariffs on all remaining Chinese

imports, which could be implemented as early as December.

The Bloomberg reported on Monday that U.S. is readying new

tariffs worth $257 billion on all remaining Chinese imports that

have not been affected so far.

The announcement could come by early December, if talks next

month between U.S. President Donald Trump and Chinese President Xi

Jinping fail to ease the trade war.

Investor fear that the imposition of the new tariffs would

negatively impact the world's economic growth.

Also in focus are U.S. economic data due this week, which

includes consumer confidence data due today, followed by ADP

private payrolls on Wednesday. Weekly jobless claims and the ISM

manufacturing index are slated for Thursday, while the jobs report

for October is set for Friday.

The greenback held steady against its major rivals in the Asian

session, with the exception of the yen.

The greenback strengthened to 1.2729 against the pound, a level

unseen since August 20. The greenback is poised to challenge

resistance around the 1.25 region.

The latest Distributive Trades Survey from the Confederation of

British Industry showed that British retail sales growth eased

noticeably in October after four straight months of firm sales

growth during the summer.

The retail sales balance fell to +5 percent in October.

Nonetheless, retailers expect sales growth to pick-up next month,

with the balance at +17 percent.

The greenback climbed to a 4-day high of 1.1346 versus the euro,

following a decline to 1.1388 at 3:00 am ET. On the upside, 1.11 is

possibly seen as the next resistance level for the greenback.

Preliminary flash estimate from Eurostat showed that the euro

area economy grew at a slower pace in the third quarter.

Gross domestic product expanded only 0.2 percent sequentially

after rising 0.4 percent in the second quarter. The rate was

forecast to remain at 0.4 percent.

The greenback spiked up to more than a 3-month high of 1.0034

against the Swiss franc, from a low of 1.0008 hit at 3:00 am ET.

The greenback is seen finding resistance around the 1.02 level.

Survey by KOF Swiss Economic Institute showed that a measure

reflecting Switzerland's economic trends declined in October after

rising in the previous month, suggesting that the alpine economy is

set to growth at an average rate in coming months.

The economic barometer dropped to 100.1 from 102.3 in September,

which was revised from 102.2. In August, the score was 98.9.

Reversing from an early low of 112.31 against the yen, the

greenback advanced to near a 3-week high of 112.98. If the

greenback rises further, it may find resistance around the 115.00

region.

Data from the Ministry of Internal Affairs and Communications

showed that Japan's unemployment rate declined in September.

The jobless rate fell to 2.3 percent from 2.4 percent in August.

This was the lowest rate since early 1990s. The rate was expected

to remain unchanged at 2.4 percent.

The greenback reached as high as 1.3144 against the loonie, up

from a low of 1.3101 seen at 4:30 am ET. The next possible

resistance for the greenback is seen around the 1.33 area.

On the flip side, the greenback dropped to 0.7104 against the

aussie, reversing from a high of 0.7053 hit at 5:00 pm ET. Next key

support for the greenback is seen around the 0.725 level.

The greenback held steady against the kiwi, after declining to a

6-day low of 0.6559 at 3:00 am ET. At yesterday's close, the pair

was worth 0.6521.

The U.S. consumer confidence for October is due at 10:00 am

ET.

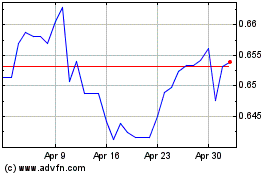

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

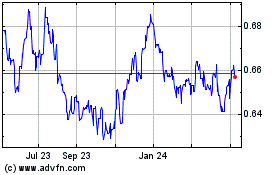

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024