Australian, NZ Dollars Advance Amid Rising Risk Appetite

October 29 2018 - 11:48PM

RTTF2

The Australian and New Zealand dollars climbed against their

major counterparts in the Asian session on Tuesday amid rising risk

appetite, as sentiment boosted after China's securities regulator

said it would enhance market liquidity, and encourage share

buybacks and mergers and acquisitions by listed firms.

The China Securities Regulatory Commission said that it would

increase stock market liquidity, lessen unnecessary interference in

trading, and create a level playing ground for investors in order

to prevent a slide in shares.

Market sentiment also got a boost amid reports that China is

considering a tax cut to revive its flagging automotive market.

Figures from the Australian Bureau of Statistics showed that

Australia's building approvals increased in September driven by

construction of apartments.

Dwelling approvals rose by seasonally adjusted 3.3 percent in

September but slower than the 3.8 percent rise economists had

expected.

The aussie climbed to 0.7096 against the greenback and 1.6038

against the euro, off its early lows of 0.7053 and 1.6118,

respectively. The aussie is seen finding resistance around 0.72

against the greenback and 1.57 against the euro.

The aussie strengthened to a 6-day high of 79.98 against the

yen, after falling to 79.25 at 5:00 pm ET. The next possible

resistance for the aussie is seen around the 82.00 level.

Data from the Ministry of Internal Affairs and Communications

showed that Japan's unemployment rate declined in September.

The jobless rate fell to 2.3 percent from 2.4 percent in August.

This was the lowest rate since early 1990s. The rate was expected

to remain unchanged at 2.4 percent.

Reversing from an early 4-day low of 0.9261 against the loonie,

the aussie advanced to 0.9303. The aussie is likely to test

resistance around the 0.94 level.

The kiwi firmed to a session's high of 0.6556 against the

greenback, after having dropped to 0.6520 at 5:00 pm ET. If the

kiwi rises further, 0.67 is likely seen as its next resistance

level.

The kiwi appreciated to a 6-day high of 73.89 against the yen

and an 11-day high of 1.7359 against the euro, from its early lows

of 73.26 and 1.7444, respectively. On the upside, 75.00 and 1.71

are likely seen as the next resistance levels for the kiwi against

the yen and the euro, respectively.

The kiwi rose to 1.0819 against the aussie, from an early low of

1.0844, and held steady thereafter. The kiwi is poised to find

resistance around the 1.06 level.

Looking ahead, Swiss KOF leading indicator and German jobless

for October, Eurozone GDP data for the third quarter and economic

sentiment index for October are due in the European session.

German preliminary consumer inflation data for October is set

for release at 9:00 am ET.

In the New York session, U.S. consumer confidence for October

and S&P Case/Shiller home price index for August will be

out.

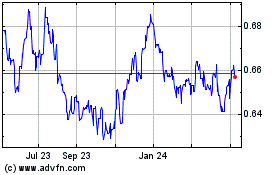

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Mar 2024 to Apr 2024

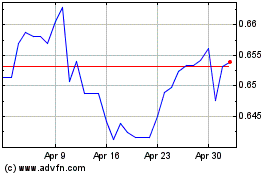

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Apr 2023 to Apr 2024