Australian Dollar Firms Amid Rising Risk Appetite

August 07 2019 - 11:16PM

RTTF2

The Australian dollar strengthened against its major

counterparts in the Asian session on Thursday amid rising risk

appetite, as Beijing moved to stabilize the yuan amid concerns a

big jump could trigger capital outflows.

The U.S. and China will resume trade talks in September, but

hopes for an agreement are low.

Solid trade data from China also lifted sentiment.

Official data showed that China's exports rose 3.3 percent

year-over-year in July, defying expectations for a fall of 1

percent.

Imports fell 5.6 percent, while economists had predicted a

decline of 9.0 percent.

Consequently, trade surplus rose to $45.06 billion versus

forecasts for $42.65 billion.

The aussie rose to a session's high of 0.6783 against the

greenback, from a low of 0.6746 hit at 9:15 pm ET. If the aussie

rises further, 0.69 is seen as its next resistance level.

The aussie climbed to a 2-day high of 72.10 against the yen,

from yesterday's closing value of 71.81. The next possible

resistance for the aussie is seen around the 76.00 level.

The Australian currency that closed Wednesday's trading at

1.6568 against the euro advanced to a 2-day high of 1.6523. The

aussie is likely to find resistance around the 1.61 level.

The aussie was trading higher at 1.0492 against the kiwi, up

from a low of 1.0460 seen at 8:30 pm ET. On the upside, 1.06 is

possibly seen as the next resistance level for the aussie.

The aussie bounced off to 0.9007 against the loonie, from an

early low of 0.8975, and held steady thereafter. The aussie is seen

finding resistance around the 0.92 level.

Looking ahead, the European Central Bank's economic bulletin is

due in the European session.

In the New York session, Canada new housing price index for

June, U.S. weekly jobless claims for the week ended August 3 and

wholesale inventories for June will be out.

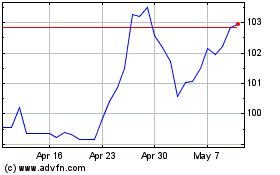

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

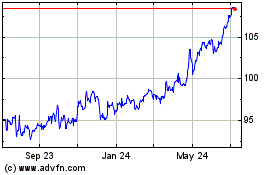

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024