Australian Dollar Slides On Disappointing Inflation Data

April 23 2019 - 11:13PM

RTTF2

The Australian dollar slipped against its major counterparts in

the Asian session on Wednesday, as nation's inflation missed

forecasts in the first quarter, stocking hopes for a rate cut by

the Reserve bank of Australia in coming months.

Data from the Australian Bureau of Statistics showed that the

consumer price index rose 0.1 percent on a seasonally adjusted

basis in the first quarter, following a rise of 0.4 percent in the

fourth quarter. Economists had forecast a 0.2 percent rise.

On a year-on-year basis, the CPI rose 1.3 percent after an

increase of 1.8 percent in the previous quarter. Economists had

expected a 1.5 percent rise in inflation.

Investors awaited U.S.-China trade talks. According to U.S.

Press Secretary Sarah Huckabee Sanders, U.S. Trade Representative

Robert Lighthizer and Treasury Secretary Steven Mnuchin will head

to Beijing next week for talks that start on April 30.

Following those talks, Chinese Vice Premier Liu He will lead a

delegation to Washington for further discussions that begin on May

8.

The aussie depreciated to 0.7027 against the greenback, its

lowest since March 11. The aussie is seen finding support around

the 0.69 level.

The aussie that closed yesterday's trading at 79.44 against the

yen fell to a 3-week low of 78.50. The next possible support for

the aussie is seen around the 77.5 level.

The aussie weakened to more than a 4-week low of 1.5959 against

the euro, compared to 1.5809 hit late New York Tuesday. If the

aussie drops further, 1.62 is possibly seen as its next support

level.

The Australian currency slipped to a 3-week low of 0.9450

against the loonie from yesterday's closing value of 0.9533. Next

key support for the aussie is likely seen around the 0.92

level.

The aussie hit a weekly low of 1.0617 against the kiwi, down

from Tuesday's closing value of 1.0668. The aussie is poised to

find support around the 1.05 level.

Looking ahead, German Ifo business climate and Swiss economic

sentiment index for April, as well as U.K. public sector finance

data for March are due in the European session.

The Bank of Canada announces its interest rate decision at 10:00

am ET. Economists expect the bank rate to remain on hold at 1.75

percent.

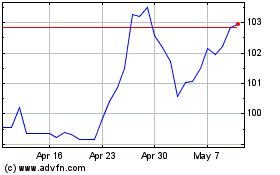

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Mar 2024 to Apr 2024

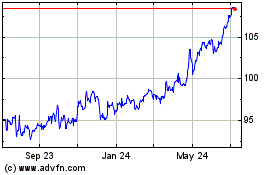

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2023 to Apr 2024