UK Bonds Gain, FTSE 100 Slides as Virus Jitters Weigh

U.K. government bond yields slide as part of global pullback

driven by mounting concerns that a global surge in Covid-19

infections will hurt economic growth. The yield on the 10-year gilt

falls to seven-day low of 0.577%, according to Tradeweb, on Monday,

coinciding with the lifting of all legal coronavirus restrictions

despite the wide spread of the Delta variant prompting a surge in

cases. London's index of bluechip shares, the FTSE 100, plunges by

almost 2.5% to 6831.97, the lowest level since mid-May. "U.K.

stocks seem far from impressed 'Freedom Day', with the final

removal of Covid restrictions doing more to raise fears of a more

pronounced outbreak that raise hopes around an economic boost,"

says Joshua Mahony, senior market analyst at online trader IG.

Companies News:

Lithium Miner Bradda Head Shares Rise on Trading Debut

Shares in Bradda Head Holdings Ltd., a North America-focused

lithium development group, rose Monday as they began trading on

London's junior AIM market.

---

Roquefort Investments Encouraged by Early Opportunities for

Acquisitions

Roquefort Investments PLC said Monday that it has been

encouraged by the initial due diligence it has carried out on some

opportunities as it sees to acquire a biotechnology business.

---

M.P. Evans Group 1H Crude Palm-Oil Production Rose; Maintains

Dividend

M.P. Evans Group PLC said Monday that crude palm-oil production

for the first half of 2021 rose 29%, and that the board maintains

its intention to recommend a total dividend.

---

Watkins Jones Names Future Chairman and CFO

Watkin Jones PLC said Monday that it has appointed Alan Giddins

as chairman-designate with immediate effect, and Sarah Sergeant as

chief financial officer-designate effective from Oct. 6.

---

Logistics Software Company Microlise to Raise GBP18.6 Mln in

London IPO

Microlise Group PLC, a provider of transport-management

software, said Monday that it plans to raise 18.6 million pounds

($25.6 million) through an initial public offering on London's

junior AIM market at a valuation of GBP156.5 million.

---

Revolution Beauty Shares Fall in London Market Debut

Shares of Revolution Beauty Group PLC fell as much as 6.3% on

Monday as the company started trading on London's junior AIM,

implying a market capitalization of 464.1 million pounds ($639

million).

---

East Star Resources to Acquire Discovery Ventures Kazakhstan in

Reverse Takeover Deal

East Star Resources PLC, a London-listed special purpose

acquisition company, requested on Monday that its shares be

temporarily suspended after reaching an agreement for the

conditional acquisition of Discovery Ventures Kazakhstan Ltd., a

deal that will constitute a reverse takeover.

---

Samuel Heath & Sons Executive Chairman Dies

Samuel Heath & Sons PLC said Monday that Executive Chairman

Sam Heath died on Friday.

---

Biffa's 1Q Revenue Rose Ahead of Internal Expectations

Biffa PLC said Monday that its performance in the first three

months of fiscal 2022 was materially ahead of management

expectations, as revenue rose when compared with pre-Covid

levels.

---

Sareum Holdings Gets GBP1 Mln Investment to Advance Drug

Development

Sareum Holdings PLC said Monday that it has raised 1 million

pounds ($1.4 million) at a premium from a high-net-worth individual

to advance its drug-development programs into the clinical

stage.

---

Zoom Video, Five9, Exxon, IBM: What to Watch When the Stock

Market Opens Today

Global stocks are broadly lower, along with government-bond

yields and commodity prices, amid renewed anxiety around the Delta

variant of Covid-19 and inflation. Here's what we're watching ahead

of Monday's open. Full market wrap here.

---

Spire Healthcare Shareholders Reject Proposed Acquisition by

Ramsay

Shares in Spire Healthcare Group PLC fell Monday after the

company said that shareholders rejected the recommended cash

acquisition of the company by Ramsay Health Care Ltd.

Market Talk:

EUR/GBP to Weaken to 0.84 By Year-End, 0.83 in 2022, Says UBS

GWM

1232 GMT - UBS Global Wealth Management maintains its year-end

target of 0.84 for EUR/GBP and expects further EUR weakness next

year to 0.83, due to diverging central bank policy. "A

stronger-than-expected economy has put the Bank of England in a

hawkish mood, meanwhile the European Central Bank has turned even

more dovish," say UBS GWM's strategist Thomas Flury and economist

Dean Turner. The ECB as likely to keep stimulus in place "much

longer" than the BOE, they say. UBS GWM expects EUR/GBP to remain

in a 0.83-0.87 range near term, but with synchronized global growth

later it could test the 0.80 level. Meanwhile, the 0.90 level is a

"hard upside resistance." EUR/GBP last trades up 0.2% at

0.8588.

---

Unilever Tipped to Report Higher 1H Sales

1252 GMT - Unilever investors will be seeking confirmation in

the consumer-goods group's first-half results Thursday about

whether it's on track to hit sales targets. Chief Executive Alan

Jope has said Unilever expects to boost underlying sales in 2021 in

line with a longer-term target range of 3-5%, with the first half

around the top of that, Hargreaves Lansdown says. "This week, we'll

find out if that target's intact," says HL analyst Sophie

Lund-Yates, adding that the company's recovery from coronavirus

disruption in regional markets such as India and Europe is likely

to be of interest. "We expect the trading picture is still mixed,"

she says.

---

Royal Mail's Parcel Fortunes Set to Face 1Q Spotlight

1257 GMT - Royal Mail's parcel-delivery business is likely to be

in focus in a first-quarter update from the U.K. mail and parcel

courier Wednesday July 21. Royal Mail's shares have eased in the

last month as investors attempt to assess how the re-opening of the

economy could affect its prospects, Hargreaves Lansdown says. "With

high streets opening up, the e-commerce boom has showed signs of

waning a little, although online retail sales remain significantly

higher than pre-pandemic levels," HL analyst Susannah Streeter

says, adding that cost control is also likely to be of

interest.

---

Royal Mail's Parcel Fortunes Set to Face 1Q Spotlight

1257 GMT - Royal Mail's parcel-delivery business is likely to be

in focus in a first-quarter update from the U.K. mail and parcel

courier Wednesday July 21. Royal Mail's shares have eased in the

last month as investors attempt to assess how the re-opening of the

economy could affect its prospects, Hargreaves Lansdown says. "With

high streets opening up, the e-commerce boom has showed signs of

waning a little, although online retail sales remain significantly

higher than pre-pandemic levels," HL analyst Susannah Streeter

says, adding that cost control is also likely to be of

interest.

---

Unilever Tipped to Report Higher 1H Sales

1252 GMT - Unilever investors will be seeking confirmation in

the consumer-goods group's first-half results Thursday about

whether it's on track to hit sales targets. Chief Executive Alan

Jope has said Unilever expects to boost underlying sales in 2021 in

line with a longer-term target range of 3-5%, with the first half

around the top of that, Hargreaves Lansdown says. "This week, we'll

find out if that target's intact," says HL analyst Sophie

Lund-Yates, adding that the company's recovery from coronavirus

disruption in regional markets such as India and Europe is likely

to be of interest. "We expect the trading picture is still mixed,"

she says.

---

EUR/GBP to Weaken to 0.84 By Year-End, 0.83 in 2022, Says UBS

GWM

1232 GMT - UBS Global Wealth Management maintains its year-end

target of 0.84 for EUR/GBP and expects further EUR weakness next

year to 0.83, due to diverging central bank policy. "A

stronger-than-expected economy has put the Bank of England in a

hawkish mood, meanwhile the European Central Bank has turned even

more dovish," say UBS GWM's strategist Thomas Flury and economist

Dean Turner. The ECB as likely to keep stimulus in place "much

longer" than the BOE, they say. UBS GWM expects EUR/GBP to remain

in a 0.83-0.87 range near term, but with synchronized global growth

later it could test the 0.80 level. Meanwhile, the 0.90 level is a

"hard upside resistance." EUR/GBP last trades up 0.2% at

0.8588.

---

Ocado Shares Drop After Warehouse Blaze

1133 GMT - Shares in Ocado Group are among the FTSE 100 Index's

biggest fallers, down more than 4% after the online grocer and

retail-technology specialist suffered a fire at one of its

warehouses in England, according to a statement. Ocado said most of

the site is in good condition and that it expects it to start

operating again within the coming week. While Ocado said the blaze

had disrupted its operations, the incident--which follows a fire at

another of the company's distribution centers in 2019--may be of

more concern to investors in terms of the company's attempts to

secure more retail customers for its technology, analysts say.

Contact: London NewsPlus, Dow Jones Newswires;

+44-20-7842-931

(END) Dow Jones Newswires

July 19, 2021 09:41 ET (13:41 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

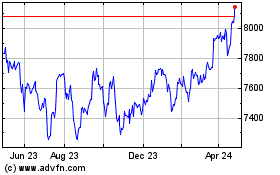

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

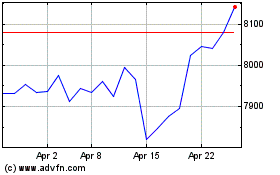

FTSE 100

Index Chart

From Apr 2023 to Apr 2024