Stocks Turn Lower on Worries About Virus Outbreak

January 24 2020 - 1:35PM

Dow Jones News

By Avantika Chilkoti and Alexander Osipovich

U.S. stocks tumbled on Friday on worries the deadly coronavirus

outbreak is spreading.

The Dow Jones Industrial Average fell 0.4% in early-afternoon

trading, while the S&P 500 dropped 0.7% and the Nasdaq

Composite was down 0.5%.

All three indexes opened with gains, but pulled back after

health officials confirmed a second U.S. case of the virus that has

killed more than two dozen people in Asia, sickened hundreds more

and led to a quarantine of the Chinese city of Wuhan.

Energy was among the worst-performing sectors of the S&P

500, pulled down by slumping prices for crude oil. U.S. oil futures

fell 2.5% to $54.19 a barrel as the widening virus outbreak

threatened to disrupt travel.

Technology was the index's best-performing sector, buoyed by

gains in semiconductor stocks.

Shares of Intel surged 9.1%. The chip maker late Thursday

reported fourth-quarter earnings that beat expectations following

an upswing in personal-computer shipments and robust demand for

chips to power data centers. Its rival Broadcom gained 1.9% after

reporting that it had secured multiyear supply agreements to

provide wireless components for Apple products.

American Express gained 2.6% after the credit-card company's

earnings beat analysts' expectations and it gave an optimistic

earnings outlook for 2020.

Overseas, the pan-continental Stoxx Europe 600 index climbed

0.9% on fresh economic data that signaled a halt to the slowdown in

the German manufacturing sector.

Preliminary data on purchasing managers' indexes, closely

watched measures of business activity, suggested that the

manufacturing sector in the eurozone -- and Germany, in particular

-- fared better than the market had expected in January. Factories

in the region saw export orders begin to stabilize after a long and

deep decline, and while the manufacturing sector continued to

contract, it did so at a slower pace than previous months.

"The markets are reacting to the signs of bottoming in German

manufacturing," said Mike Bell, global market strategist at J.P.

Morgan Asset Management. "It's pretty key because the big question

on everyone's mind has been: Is there recession risk? And the most

obvious risk there was a downturn in European manufacturing."

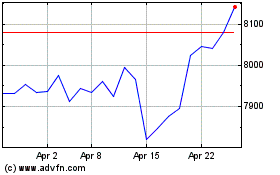

U.K. stocks rose, with the FTSE 100 index climbing 1% after the

latest purchasing managers index data was better than analysts

expected.

The readings are "the surest sign yet that the economy has

turned a corner since the election," and would likely mean the Bank

of England holds off cutting rates later this month, analysts at

Capital Economics said in a note.

The yield on the 10-year U.S. Treasury note fell to 1.687%, from

1.739% on Thursday, as investors bought government bonds. Bond

yields move in the opposite direction from prices.

In Asia, Japan's Nikkei 225 benchmark closed up 0.1% and Hong

Kong's Hang Seng finished the day up almost 0.2%. Chinese and

Korean markets were closed for public holidays.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com and

Alexander Osipovich at alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

January 24, 2020 13:20 ET (18:20 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

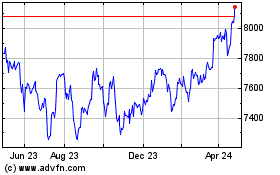

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

FTSE 100

Index Chart

From Apr 2023 to Apr 2024