By Mark DeCambre, MarketWatch , Sunny Oh

Fed to buy $60 bln Treasury bills per month into 2020

U.S. stocks surged Friday as investors turned hopeful about the

outcome of a second day of trade talks between the U.S. and China,

with President Trump set to meet China's Vice Premier Liu He later

Friday.

How did the benchmarks perform?

The Dow Jones Industrial Average rose 428 points, or 1.6%, to

26,925, the S&P 500 index advanced 49 points, or 1.7%, to

2,986, while Nasdaq Composite Index gained 147 points, or 1.8%, to

8,097.

On Thursday

(http://www.marketwatch.com/story/us-stock-index-futures-drift-lower-as-beijing-washington-tariff-talks-take-focus-2019-10-10),

the Dow rose 150.66 points, or 0.6%, to 26,496.67. The S&P 500

index climbed 0.6%, or 18.73 points, to 2,938.13. The Nasdaq picked

up 47.04 points, or 0.6%, to finish at 7,950.78.

For the week, the Dow is poised to rise 1.3%, while the S&P

500 and Nasdaq are on pace to post 1.1% and 1.4% rise,

respectively.

What drove the stock market?

(http://www.marketwatch.com/story/trump-says-hell-meet-with-chinese-vice-premier-on-friday-2019-10-10)President

Donald Trump tweeted that 'good things are happening

(https://twitter.com/realDonaldTrump/status/1182654371714211840)'

at the trade negotiations.

(http://twitter.com/realDonaldTrump/status/1182654371714211840)

He is expected to meet China's Vice Premier Liu He later Friday.

The Wall Street Journal reported

(https://www.wsj.com/articles/trump-to-meet-with-china-s-top-trade-negotiator-on-friday-11570716458?mod=article_inline)that

terms for a possible tentative deal could include China offering

more agriculture purchases, a joint pact to deter Beijing from

devaluing its currency, and, on the U.S. side, suspending planned

tariffs and relaxing export bans against blacklisted Chinese

telecom giant Huawei Technologies Co.

(http://www.marketwatch.com/story/trump-says-hell-meet-with-chinese-vice-premier-on-friday-2019-10-10)

China overnight Friday set a timetable for opening its finance

industries

(https://www.apnews.com/3e0a248000c64959abd24916f2de6953). The

China Securities Regulatory Commission said Friday overseas

financial service companies in futures, securities and mutual funds

will be able to apply for total control of onshore ventures

starting in 2020. The move came as the country speeds up its

financial markets opening.

"The whole U.S.-China trade negotiations have been a cloud over

the markets in the last few weeks. If this partial breakthrough

comes to fruition, it will give at least a temporary boost to the

markets, and we're seeing that reflected in stocks this morning,"

said Michael Arone, chief investment strategist for State Street

Global Advisors, in an interview with MarketWatch. "There seems to

be relief that there will some type of progress on these

discussions. The biggest positive that could come as a result of

the negotiations is a freeze on new U.S. tariffs set to take place

in a couple of days," he said.

On the data front, University of Michigan's preliminary consumer

sentiment report came in at 96 , above economists' estimates for a

reading of 92, according to Econoday. Meanwhile, the import price

index

(http://www.marketwatch.com/story/import-inflation-climbs-in-september-on-higher-cost-of-oil-but-most-prices-still-tame-2019-10-11)climbed

0.2% last month, the government said Friday. The cost of goods

imported into the U.S. rose in September for the first time in four

months, but most of the increase stemmed from higher oil

prices.

The Federal Reserve announced that it would buy $60 billion of

Treasury bills every month

(http://www.marketwatch.com/story/fed-says-it-will-start-to-buy-treasury-bills-next-week-to-ease-money-market-pressure-2019-10-11-1191242)

at least into the second-quarter, starting from next week. The

central bank also said it would conduct overnight repurchase

agreements at least through January of next year in order to reduce

pressures in funding markets.

Investors also will watch for comments from Boston Fed President

Eric Rosengren

(https://www.bostonfed.org/news-and-events/press-releases/2019/statement-of-eric-s-rosengren.aspx)

-- one of three dissenters in the Fed's last decision -- set to

speak at the American Economic Challenges Symposium in Madison,

Wis., at 1:15 p.m., while Dallas Fed President Robert Kaplan, is

expected to moderate a panel in San Francisco at 3 p.m. Kaplan

isn't a voting member of the rate-setting Federal Open Market

Committee.

See also: Bank stocks surge as U.S.-China trade hopes lift

Treasury yields

(http://www.marketwatch.com/story/bank-stocks-surge-as-us-china-trade-hopes-lift-treasury-yields-2019-10-11)

Which stocks are in focus?

Shares of Apple Inc.(AAPL) advanced 1.7% as analysts at Wedbush

raised its stock price target to $265 from $245. If the stock

closes above $232.07, it will set a new all-time high.

The stock for Voxx International Corp.(VOXX) fell 3.3% even

after the technology manufacturer reported that its operating

losses fell in the first half of the year.

Shares of Bed Bath & Beyond(BBBY) rose 5.4% after it named

Target Corp.'s(TGT) head of merchandising as its new chief

executive.

How did other assets trade?

The yield on the 10-year U.S. Treasury note climbed to 1.739%,

compared with 1.649% on Thursday.

(http://www.marketwatch.com/story/gold-edges-higher-ahead-of-trade-talks-2019-10-09)Gold

futures held below the psychologically significant level at $1,500.

December gold was most recently down 1.2% at $1,482.30 an

ounce.

West Texas Intermediate crude for November delivery jumped 83

cents to $54.37 a barrel on the New York Mercantile Exchange, after

an oil tanker attack in the Middle East

(http://www.marketwatch.com/story/oil-prices-jump-after-reports-of-iranian-tanker-blast-2019-10-11).

In Asia overnight Friday, Hong Kong's Hang Seng Index surged

2.3% to 26,308.44, the China CSI 300 rose 1% to reach 3,911.73, and

Japan's Nikkei 225gained 1.2% to 21,798.87. The Stoxx Europe 600,

meanwhile, advanced 1.6% to 388.91. And the FTSE 100 gained 0.3% to

7,186.36, even as the pound jumped 1.8% against the dollar, amid

renewed Brexit optimism

(http://www.marketwatch.com/story/uk-stocks-drift-before-trade-talks-as-gdp-edges-lower-in-august-2019-10-10).

(END) Dow Jones Newswires

October 11, 2019 11:40 ET (15:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

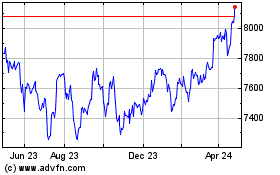

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

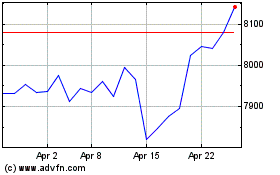

FTSE 100

Index Chart

From Apr 2023 to Apr 2024