Global Stocks Pressured by Weak Economic Data

October 03 2019 - 8:34AM

Dow Jones News

By Avantika Chilkoti

-- U.S. stock futures rise

-- Asian, European stocks drop

-- Treasury yields dip

Global stocks wavered as a fresh round of weak economic data

raised investors' concerns about world growth.

In the U.S., futures for the S&P 500 gained 0.2%.

Among the biggest risers in U.S. premarket trading was PepsiCo,

which saw its shares climb 3% on a better-than-expected earnings

report. The snacks and beverage company posted strong revenue

growth, though foreign exchange moves weighed on the business.

The Stoxx Europe 600 slipped 0.1% in midday trade, after

suffering its worst performance this year Wednesday.

In Asia, Japan's Nikkei was down 2%, while Hong Kong's Hang Seng

closed up 0.3%. Stock markets in China and South Korea were closed

on Thursday.

Fresh data added to the gloomy outlook for the broader European

economy. The IHS Markit composite purchasing managers index fell to

50.1 in September from 51.9 in August, the lowest reading since

June 2013.

U.K. stocks were a weak spot in the region, with London's FTSE

100 down 0.6% and the FTSE 250 down 0.5% after a weak reading on

the country's services sector, and fresh Brexit tensions.

The U.K. services purchasing managers index hit a six-month low

of 49.5, below the 50 level that marks contraction. The figures

reignited concerns that the economy is in recession, analysts at

Capital Economics said, adding that economic performance will

remain "well below par" while Brexit negotiations drag on.

Meanwhile, European officials gave a cool response to British

Prime Minister Boris Johnson's new proposals to break the deadlock

over Brexit, just weeks ahead of the U.K.'s scheduled exit from the

European Union.

Investors were also still digesting the news that the U.S. will

impose new tariffs on EU goods, including jetliners, Irish and

Scotch whiskies, cheeses and hand tools, starting later this

month.

"The total size or volume of tariffs being applied to what does

amount to quite an array of goods is actually very small when you

consider just the goods trade between the U.S. and the European

Union," said Matt Cairns, rates strategist at Rabobank.

Shares in Airbus were up 3.4% Thursday, while Pernod Ricard

gained 3.1% and Rémy Cointreau was up 5.7%.

Among the biggest gainers in Europe was fashion retailer Hennes

& Mauritz. Its shares gained 6.4% after the company reported

its third-quarter earnings, which showed a 6% rise in net sales

with a reduction in markdowns helping operating profits.

The yield on U.S. 10-year Treasurys dropped to 1.568% Thursday,

from 1.594% Wednesday. Bond yields and prices move in opposite

directions.

The WSJ Dollar Index, which measures the currency against a

basket of its peers, was down 0.1%.

"The economy is fine without further escalation of the trade

war, but what does an investor really have in terms of the next

step in trade wars?" said Emiel van den Heiligenberg, head of asset

allocation at Legal and General Investment Management. "No one can

really predict what Trump will do next and that makes investors

nervous."

Among the biggest gainers in Europe was fashion retailer Hennes

& Mauritz. Its shares gained 6.2% after the company reported

its third-quarter earnings, which showed a 6% rise in net sales

with a reduction in markdowns helping operating profits.

In commodities, global oil benchmark Brent crude dropped 0.1% to

$57.66 per barrel. Gold dropped 0.1%.

Later Thursday, investors will be watching for data on U.S.

services activity in September, as well as August factory orders,

for clues about growth in the world's largest economy.

Joanne Chiu contributed to this article.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com

(END) Dow Jones Newswires

October 03, 2019 08:19 ET (12:19 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

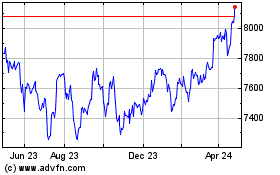

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

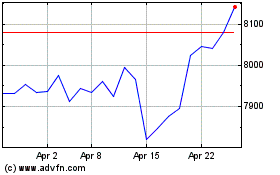

FTSE 100

Index Chart

From Apr 2023 to Apr 2024