EUROPE MARKETS: European Markets Gloomy On Trump Trade War Tweets

August 12 2019 - 8:12AM

Dow Jones News

By Dave Morris

European markets declined as a resolution to the U.S.-China

trade war seemed to move further away.

How did markets perform?

The Stoxx Europe 600 edged lower as investors abandoned the

hints of optimism from Thursday and Friday's sessions.

The U.K.'s FTSE 100 index was the most negatively impacted among

top regional indexes, with unrest in Hong Kong driving major banks

sharply downward.

German's DAX was close to flat, despite falling auto maker

shares on news of slowing hybrid and fully electric auto sales in

China.

The pound rebounded slightly from a disastrous few sessions,

with traders taking stock of last week's dramatic moves lower.

What's moving the markets?

U.S. President Donald Trump continued firing Twitter salvos in

the trade dispute with China on Saturday. Trump said China badly

wanted to make a deal with the U.S., and that they may want to wait

to see if a Democrat wins the election in 2020 "so they can

continue the great ripoff of America". The tweets cast doubt over

whether talks scheduled to be held in September would take

place.

Italian Deputy Prime Minister Matteo Salvini dismissed reports

in the country's media Saturday that his party would call for

leaving the euro in a snap election campaign. Salvini's party,

which is part of the country's governing coalition, filed a

no-confidence motion Friday. It has recalled its members to Rome

with the intention of pushing for a vote on the motion this

week.

Which stocks are active?

Tullow Oil PLC (TLW.LN) shares leapt when it released a

statement Monday morning announcing the oil it had discovered in an

exploration well off Guyana had exceeded its forecast. AJ Bell

investment director Russ Mould said "It is an encouraging start to

drilling on the Orinduik block. Investors don't have too long to

wait to see if this is a one-off or if a repeat performance can be

conjured, with drilling on a second well set to get underway

imminently."

AMS AG (AMS.EB) shares fell significantly after the Austrian

semiconductor company announced it would offer to buy Osram Licht

AG (OSR.XE) for EUR38.50 per share, in an all-cash offer valuing

the company at EUR3.7 billion. Shares in the German lighting

company moved significantly higher.

NMC Health (NMC.LN) shares continued to fall despite reaffirming

its full-year earnings guidance in a statement last week, saying

business was still in line with its previous views. Shares in the

health-care provider are down more than 50% in the past 12

months.

(END) Dow Jones Newswires

August 12, 2019 07:57 ET (11:57 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

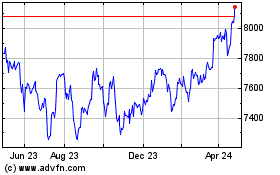

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

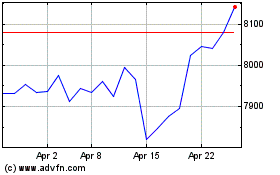

FTSE 100

Index Chart

From Apr 2023 to Apr 2024